Soft landing under challenges from Hawkish Fed and emerging recession signals

Austin Or, CFA

Higher for longer rate and reduced rate cuts next year

On Sep 20, the Federal Reserve announced that it would continue to maintain the federal funds rate at

5.25% to 5.50%, and most central bankers indicated that at least one more 25bp hike by

November/December of the year was on the cards, and postpone the rate cut to later time in 2024 and

lessen rate cuts to just two, below previous expectations.

Watch out the 4 turmoils – UAW strike, government shutdown, student loan, higher oil price UAW strike.

The United Auto Workers moratorium that began on September 15 continues. The strikes

have cost the U.S. economy more than $1.6 billion in the first week. With car inventories still at historic

lows, the strike could increase the price of new and used cars, fueling inflation. The weekly impact on

U.S. gross domestic product (GDP) growth is estimated at about 0.1%. Assuming the strike ends within

4 to 6 weeks, the impact on Q4 GDP is 0.4 to 0.8 percentage points; if it takes several months, Q4 GDP

may decrease by more than 2 percentage points.

Government shutdown. The U.S. government will shut down at the end of September if Congress

cannot agree on a spending deal for the next fiscal year, which starts on October 1. Goldman Sachs

predicts that each week the shutdown lasts will reduce economic growth by 0.2%.

Student Loans. Student loan payments will resume in October after years of disruption during the

COVID-19 pandemic. It is reported that about 44 million Americans hold about US$1.7 trillion in student

loan debt. The average student loan borrower owes 20,000 to 25,000 US dollars, which means that

each person has to pay an average of 200 to 300 US dollars per month, which may led to an overall

decline in retail sales and consumer spending.

Oil prices. As OPEC and Russia cut production, the U.S. faces reduced supply, bound to push up oil

prices. Brent oil rose to more than $90 per barrel and is forecasted to hit $107 or higher. Rising oil

prices have fueled the risk of inflation, which may affect consumer spending.

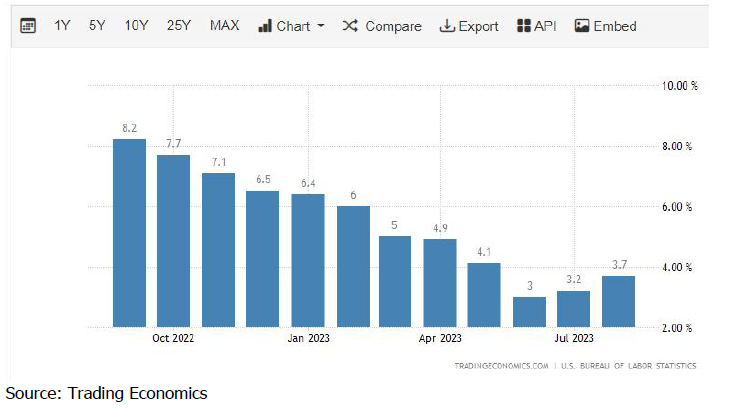

Inflation is poised to rebound in the short term but to stay with assured downtrend

Under the continued tightening effect of the Fed, overall price increases have been basically brought

under control. However, the recent surge in oil prices and supply disruptions caused by the latest strike

will cause inflation to pick up in Q4. Based on a rough rule of thumb that an unexpected 20% increase

in crude oil prices will induce a 10% increase in gasoline consumer prices, and the CPI is expected to

rise by an empirical increase of 0.3ppt given the current oil price projection. As the employment

participation rate rises, and labor supply and demand become more balanced, wage growth will slow. At

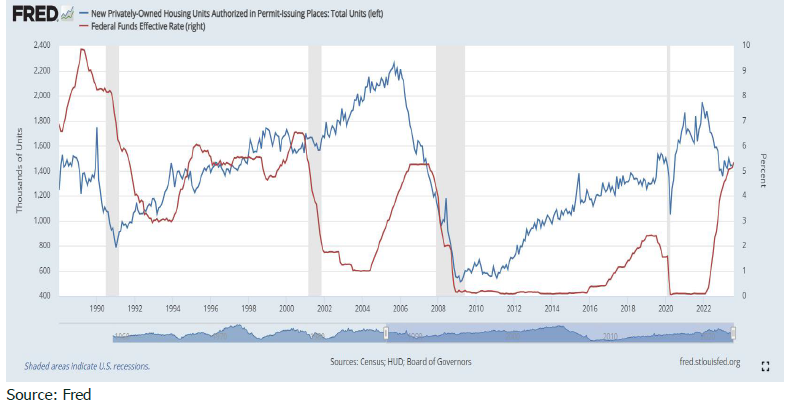

the same time, high interest rates have suppressed demand for home purchases and housing prices.

Therefore, U.S. inflation tends to slow further, and it is unlikely to see any further dramatic spurt in

inflation levels.

Controversy between soft landing and recession

Despite the brutal rate hikes, the US economy has remained robust and achieved 2.1% yoy growth in

Q2, and an expected 3.7% growth in Q3, bolstered by strong labor market, consumption and

moderating inflation. A set of economic indicators in August portray the good shape of the state

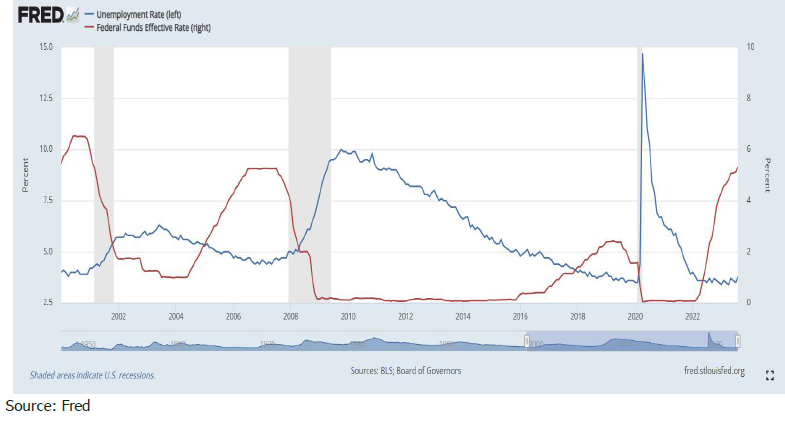

economy and seemingly support the expected outcome of soft landing – non-farm payrolls up 187,000

with an amicable 3.8% unemployment rate, retail sales up 2.47%, hourly wage up 4.29%, non

manufacturing PMI is 54.5 and above 50. However, multiple signs of recession are emerging and put

the soft landing belief into question. First of all, the high borrowing rates have reached a tipping point

that more than 450 U.S. companies have filed for bankruptcy protection till August this year, and the

corporate bankruptcy trend is expected to last, leading to higher unemployment and diminution of

consumer spending. Headwinds for the consumer are also building. According to the San Francisco Fed,

the excess savings will be dried up in Q3, while other institutions like CICC forecasts that it will be totally

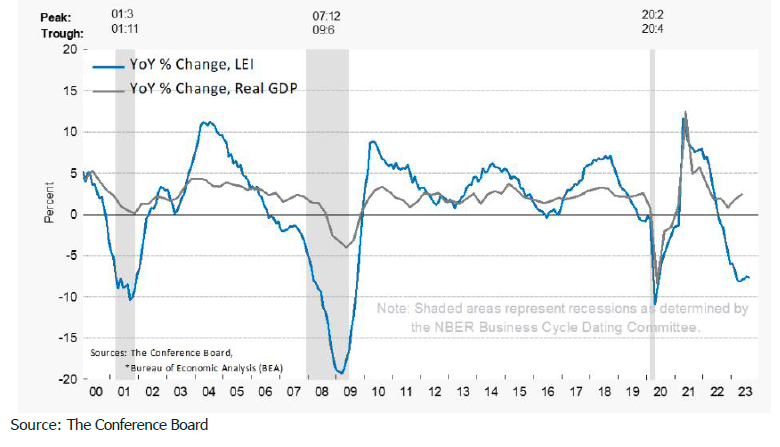

consumed in Q2 next year. Manufacturing PMI and leading indicators are other alarms to the coming

downturn of economy. The Manufacturing PMI has been below 50 for a protracted duration of 10

months, and the US CB leading index has now fallen for nearly a year and a half straight, indicating the

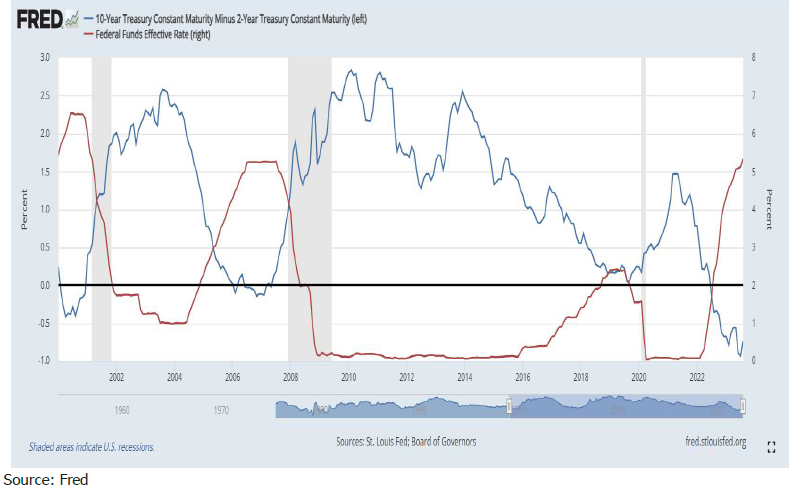

economy is heading into a challenging growth period. Last but not least, the inverted yield curve,

indicated by the negative 10yr-2yr yield spread, have persisted for 13 months, suggesting that recession

is imminent.

Prediction

- Plodding economy into 2023Q4 and 2024. Goldman Sachs forecasts that Q4 GDP will fall to

1.3% from the 3.1% expected in Q3 due to the impacts of the recent adverse events. Fed officials

expect economic growth to slow next year to about 1.5 per cent, from 2.1 per cent this year, and the

unemployment rate to go no higher than 4.1 per cent. - Further cooling of inflation. The “Summary of Economic Forecasts” shows that the Fed expects

core inflation to be 3.7% in 2023, lower than the 3.9% forecast in June, and will fall to 2.6% next year

and 2.3% in 2025. - Growing short term market volatility as treasury yields soar. As the market expects the Federal Reserve to maintain high interest rates for a long time next year, the 10-year U.S. Treasury yield rose to 4.54%, the highest level since October 2007, while the 30-year U.S. Treasury yield rose to 4.66%, the highest level since April 2011. After Fed’s higher for longer rate claim, S&P500 has registered more than 7% decline from the peak in July. The higher yields of treasury bonds will reduce the attractiveness of equities, beseting stock market in the near term.

- Year end S&P 500 forecast: 3,900 – 4,900. Wall Street’s and other financial institutions’ forecast

for the S&P 500 Index at the end of 2023 is between 3,900 points and 4,900 points, and the median at

4,350 points. Oppenheimer Asset Management raised its year-end price target for the S&P 500 to 4,900, on account of upbeat employment and inflation trends, a recovery from the banking crisis, and healthy corporate earnings. Bank of America believes that artificial intelligence, automation and labor efficiency are expected to drive productivity improvements among U.S. companies, and good macroeconomic and earnings data will push the stock market up to 4,600 points. On the contrary, Morgan Stanley predicts that as revenue and profit margins will further shrink, the profits of U.S. companies will plummet by 16%, and U.S. stock market will touch 3,900 points. - Continued earnings growth view for 2024. Despite the recession concern, S&P 500 Earnings Per Share Forward Estimate by Standard and Poor reveals that earnings level will continue to surge from 48.41 in Q12023 to 60.02 in Q42023, and the growth will extend into 2024 to reach 60.02 in Q42024.

US Recession Tracker Dashboard

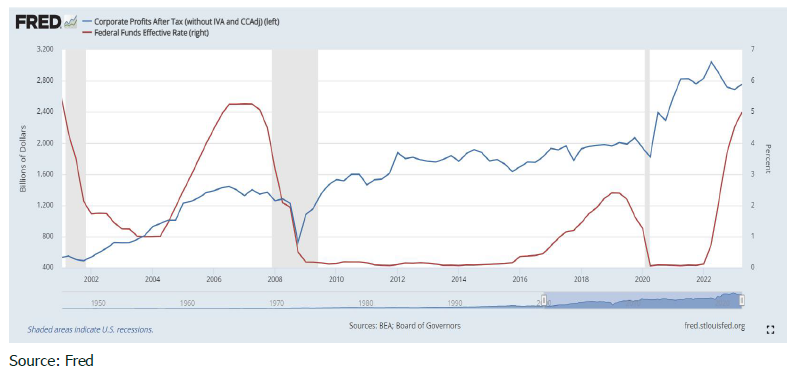

Corporate earnings

S&P 500 Earnings Per Share

10 yr - 2 yr yield spread

Unemployment rate

Nonfarm openings

Headline CPI

New housing permits

CB Leading Economic Index

Disclaimer

All information used in the publication of this newsletter has been compiled from publicly

available sources that are believed to be reliable, however we do not guarantee the accuracy

or completeness of this report and have not sought for this information to be independently

verified. Forward-looking information or statements in this report contain information that is

based on assumptions, forecasts of future results, estimates of amountsnot yet determinable,

and therefore involve known and unknown risks, uncertainties and other factors which may

cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages,

costs or expenses incurred or suffered by you arising out or in connection with theaccess to, use

of or reliance on any information contained on this note.