Elevated CPI, strong nonfarm payroll and retail sales call for further rate hike

Austin Or, CFA

September nonfarm payrolls beats expectation with steady wage growth

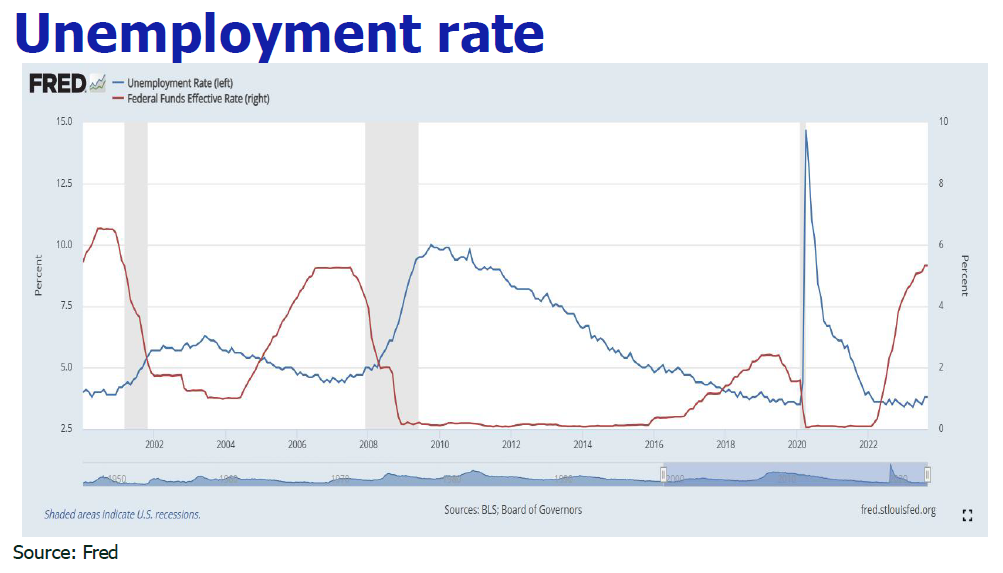

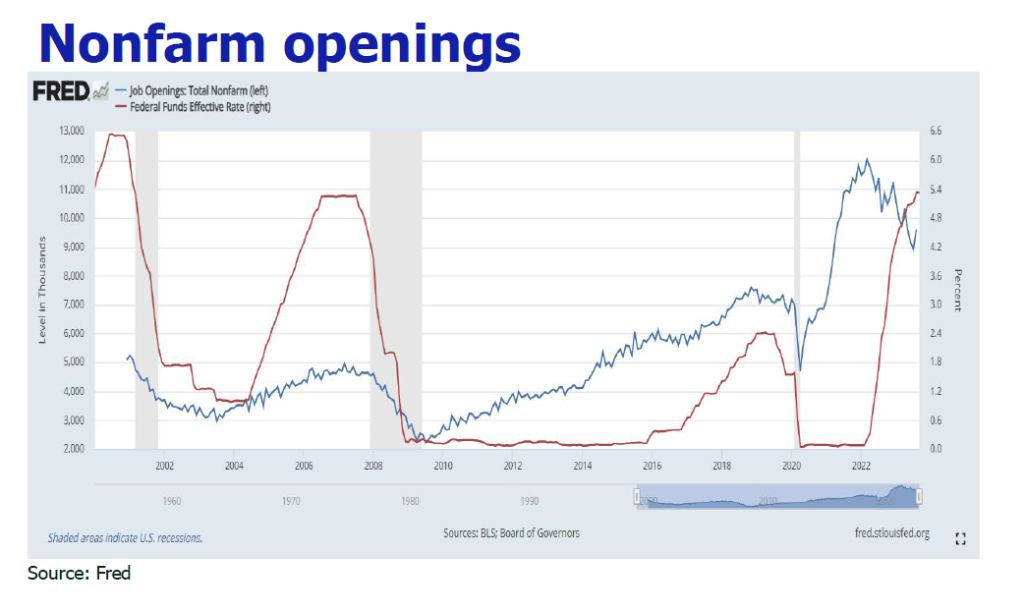

U.S. non-farm payrolls soared in September, with 336,000 non-farm jobs added in September, an increase that was almost double Wall Street’s expectations. The surge is remarkble compared to the previous increase by 187,000. The unemployment rate held steady at 3.8% in September 2023, missing expectations of 3.7%. The rate of monthly wage growth was steady at 0.2% September, slightly below forecasts of 0.3%. On an annual basis, the growth average hourly earnings eased to 4.2%, down from August’s 4.3% and expectations of 4.3%.

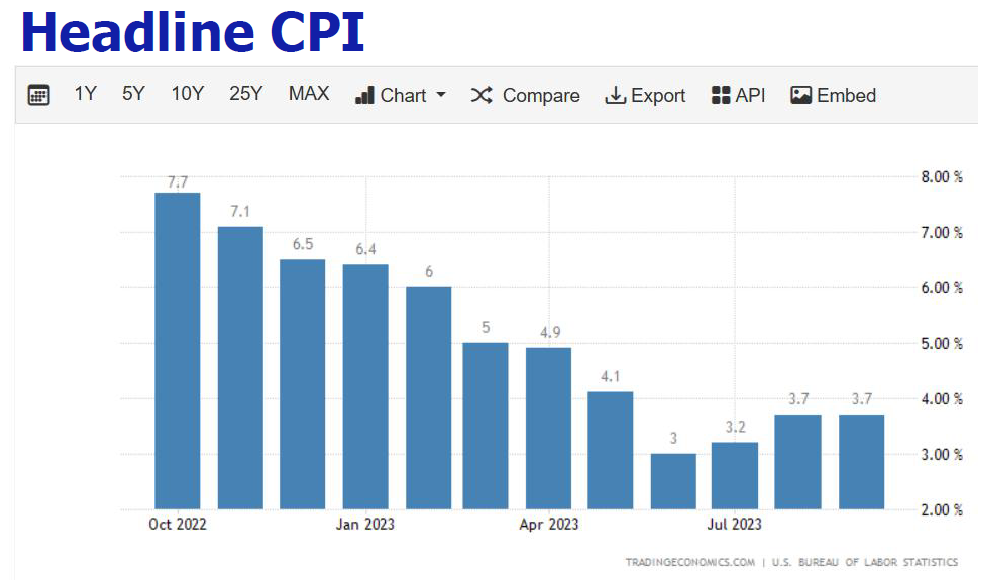

CPI rallied due to higher housing and oil prices

A report released by the U.S. Department of Labor on Thursday showed that the U.S. CPI increased by 3.7% year-on-year in September, slightly higher than the expected 3.6% and the previous value of 3.7%. The U.S. core CPI increased by 4.1% year-on-year in September, in line with expectations, and the previous value was 4.30%. Housing costs remain a major contributor to rising inflation. The housing inflation index, which accounts for about one-third of the weight of the CPI, rose 0.6% month-on-month and 7.2% year-on-year. Car prices were mixed, with new cars rising 0.3% month-on-month and

second-hand cars falling 2.5%. The rise in the gasoline index was also the main reason for the monthly increase. Energy prices increased by 1.5% month-on-month, of which gasoline prices increased by 2.1%, fuel oil prices increased by 8.5%, and food prices increased by 0.2% month-on-month for the third consecutive month.

September retail sales top expectations as consumers defy high inflation and interest rates

U.S. retail sales data in September increased strongly by 0.7% from the previous month, far exceeding market expectations of 0.3%, achieving the sixth consecutive month of growth. Retail sales excluding gasoline rose 0.7% in September. 8 of 13 retail categories recorded sales growth in September, including restaurants, car dealerships and personal care stores. The increase suggests that consumer demand remains strong despite a recent rise in energy price-driven inflation. While wage growth is starting to lose steam, the labor market generally remains strong, giving Americans room to continue spending.

Prediction

- Further rate hike is still ahead.

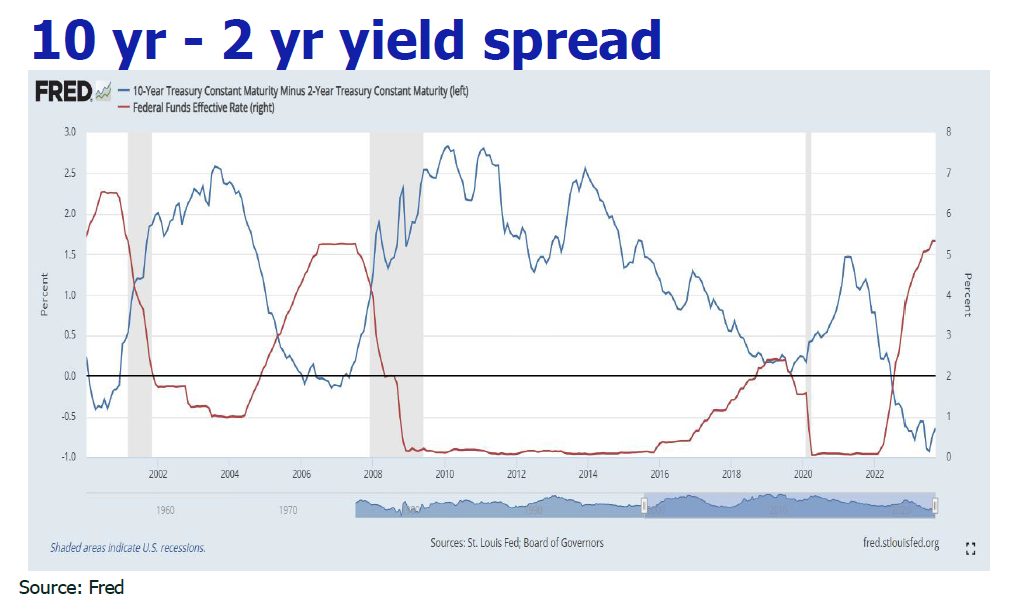

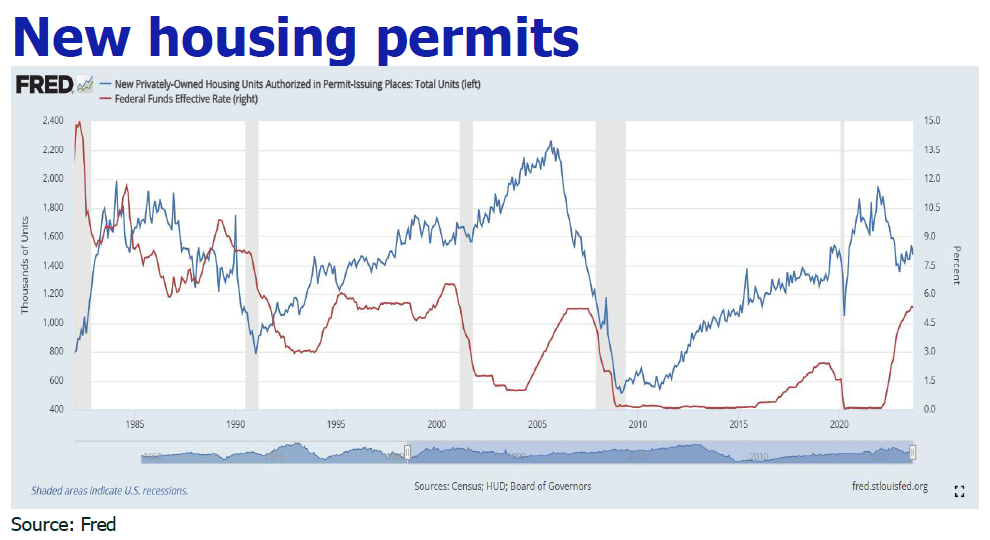

The higher than expected CPI, the strong labor market and the energetic retail sales strengthened the perspective of further rate hike this year. Now, close to 60% of economists believe the Federal Reserve has concluded its current cycle of raising rates, after hitting a 22-year peak between 5.25% and 5.5% in July. Approximately half of the economists predict the Fed will start reducing rates in Q2 next year as economic growth decelerates. Traders see an increased chance that the Fed will raise interest rates again this year and keep rates unchanged for longer next year. The probability of suspending interest rate hikes in November is still high, but the probability of interest rate hikes in December and January has increased significantly, to 35.5% and 12.1% respectively. Futures contracts based on the Federal Reserve policy rate currently reflect that the probability of a rate hike in Decemeber is about 40%, compared with about 28% before the report was released. If interest rate increases by 25 basis points, the Fed’s policy interest rate will reach a range of 5.5%-5.75%. Traders now factor in two rate cuts in 2024, anticipating the first 25bp interest rate cut to take place in September 2024, and the rate level to fall by about a percentage point to 4.6% after the two rate cuts. - U.S. consumption is on the verge of retracement after the last dance.

The core retail sales in September are known to be 0.6%, significantly lower than the previous value (+0.9%), indicating that residents’ actual consumption demand is weakening, releasing a signal of consumer market awareness. In addition, the extra saving accumulated by Americans during the epidemic is being used up. The San Francisco Federal Reserve Bank indicated that except for the top 20% of households, all other households ’ excess savings were exhausted by the end of September. That the consumer confidence expectations index fell below 80 in September, and credit card spending fell by 10.8% in September and 11.9% in the first week of October, exceeding the -10% in April 2020 during the worst period of the epidemic, also signal a deteriorating consumption outlook. The situation may come even sooner as about half of large and medium-sized banks are implementing tougher standards for commercial and industrial lending. Outside of the pandemic, this is the highest ratio since the 2008 financial crisis. The impact is expected to be felt in the fourth quarter of this year. When businesses cannot afford to borrow easily, it often results in weak investment and hiring, and thus detering consumption. - Economists become more confident that Fed is able to avert recession.

A report by The Wall Street Journal states that economists have reduced the likelihood of a recession within the next year from an average of 54% in July to a more hopeful 48%. This signifies the first drop below 50% since the middle of last year. The optimism stems from three key dynamics: falling inflation, the halt in interest rate hikes by the Federal Reserve, and a resilient labor market paired with better-than-expected economic growth. Economists anticipate a 2.2% rise in the gross domestic product (GDP) in Q4 2023, showing a significant upward revision from the former forecast of 1% growth. Despite possible challenges such as shrinking savings and tightening credit conditions, most economists are confident in the Fed’s ability to achieve a “soft landing”, where inflation decreases without causing a recession. They forecast inflation to drop to 2.4% by the end of next year and 2.2% by the end of 2025. - A shallow recession is still possible in the first half of 2024.

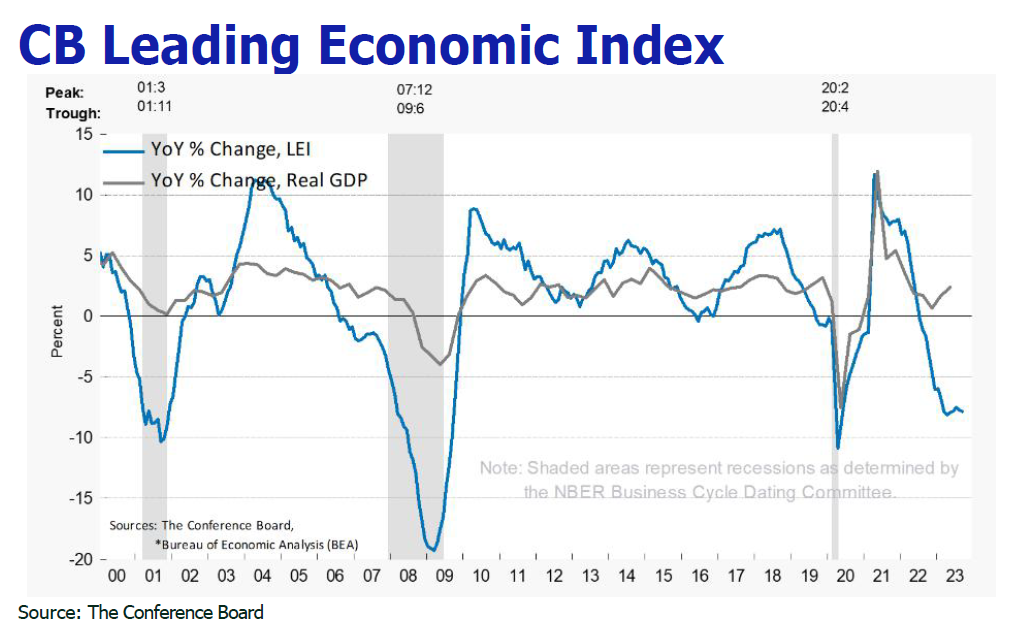

The Leading Economic Index for the US fell again in September, marking a year and a half of consecutive monthly declines since April 2022. In September, negative or flat contributions from nine of the index’s ten components more than offset fewer initial claims for unemployment insurance. Although the six-month growth rate in the LEI is somewhat less negative, and the recession signal did not sound, it still signals risk of economic weakness ahead. So far, the US economy has shown considerable resilience despite pressures from rising interest rates and high inflation. Nonetheless, The Conference Board forecasts that this trend will not be sustained for much longer, and a shallow recession is likely in the first half of 2024.

Disclaimer

All information used in the publication of this newsletter has been compiled from publicly

available sources that are believed to be reliable, however we do not guarantee the accuracy

or completeness of this report and have not sought for this information to be independently

verified. Forward-looking information or statements in this report contain information that is

based on assumptions, forecasts of future results, estimates of amountsnot yet determinable,

and therefore involve known and unknown risks, uncertainties and other factors which may

cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages,

costs or expenses incurred or suffered by you arising out or in connection with theaccess to, use

of or reliance on any information contained on this note.