Convicted rate cuts to weather upcoming economic headwind

Austin Or, CFA

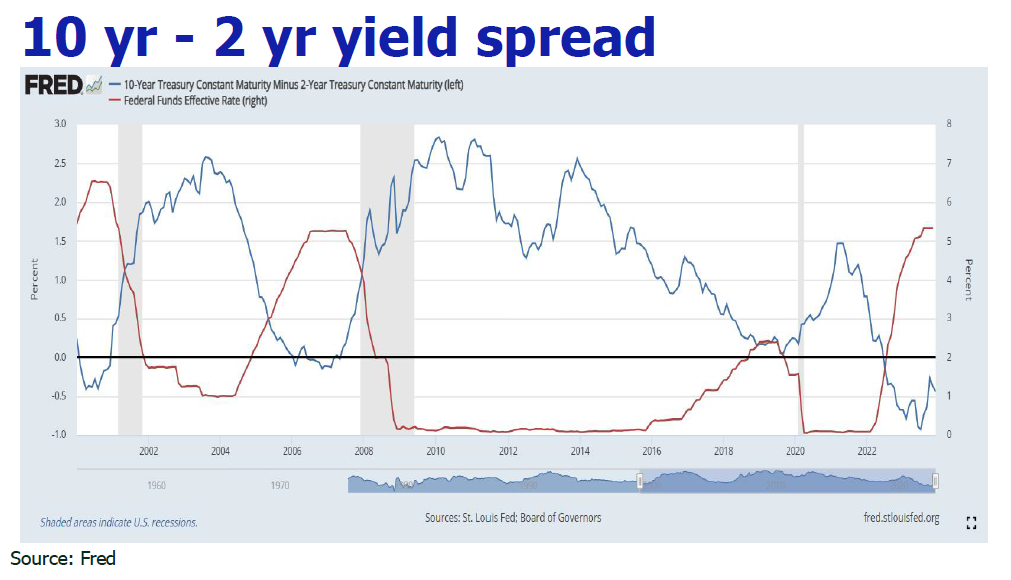

Rate frozen at 5.5%, 75 b.p. – 125 b.p. rate cut in sight for 2024

The Fed kept interest rates unchanged for the third consecutive meeting in December and sent out the strongest signal of the end of the rate hike cycle through the dot plot. Federal Reserve officials unanimously supported keeping the target range for the federal funds rate unchanged at 5.25% to

5.5%. The median rate in 2024 shown by the dot plot is 4.6%, implying a 75 basis point rate cut next year, and a 100 basis points cut in 2025. However, Wall Street banks generally expect more aggressive cuts by 1% to 1.25%.

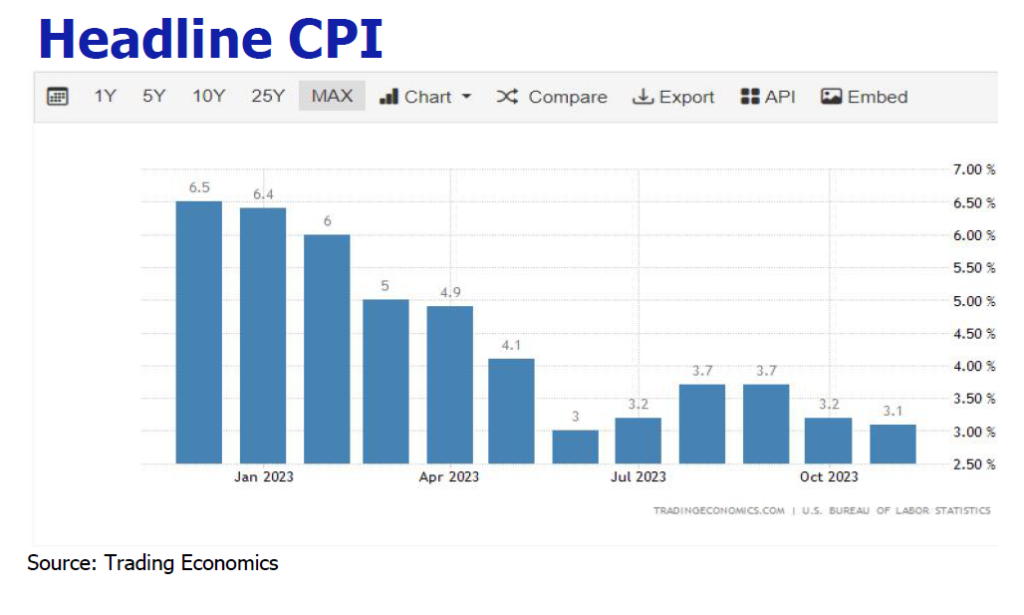

Receding CPI and PCE echo rate cut speculation

The U.S. CPI increased by 3.1% year-on-year in November, the same as market expectations, and the previous value was 3.2%. In terms of subdivided items, the energy index fell by 2.3% month-on-month in November, of which the gasoline index fell by 6.0%. The food index rose 0.2% in November, a slight slowdown from 0.3% in October. Core CPI increased by 4.0% year-on-year in November, in line with market expectations, and the previous value was 4.0%; after a month-on-month increase of 0.3% in October, the increase remained flat at 0.3% in November. The increase was mainly driven by rents, motor vehicle insurance, and medical care. Second-hand car prices rose for the first time since May, while only new cars and furniture and clothing price index fell. Housing costs which account for about one-third of the entire CPI index remained high and rose 0.4%, offsetting lower gasoline prices. PCE prices increased by 2.6% year-on-year in November vs 2.9% in October, but fell by 0.1% month-on-month, the first decline since April 2020. Among which, service industry prices increased by 0.2%, while a 0.7% drop in commodity prices, a 2.7% drop in energy prices and a 0.1% drop in food prices helped curb inflation during the month. The core PCE price index rose 0.1% month-on-month, similar to October; the year-on-year increase slowed to 3.2%, lower than October’s 3.5%, both the headline and core PCE were lower than market expectations.

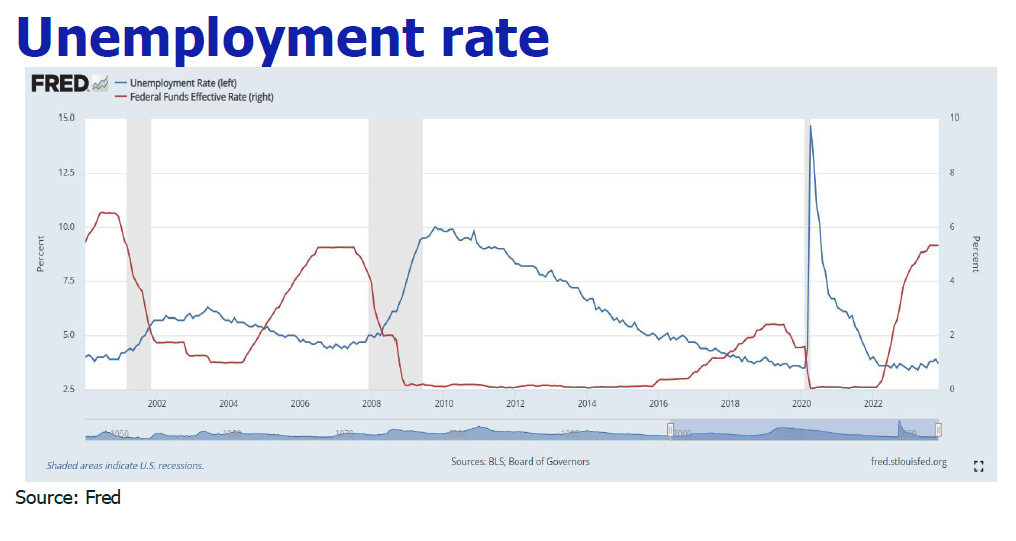

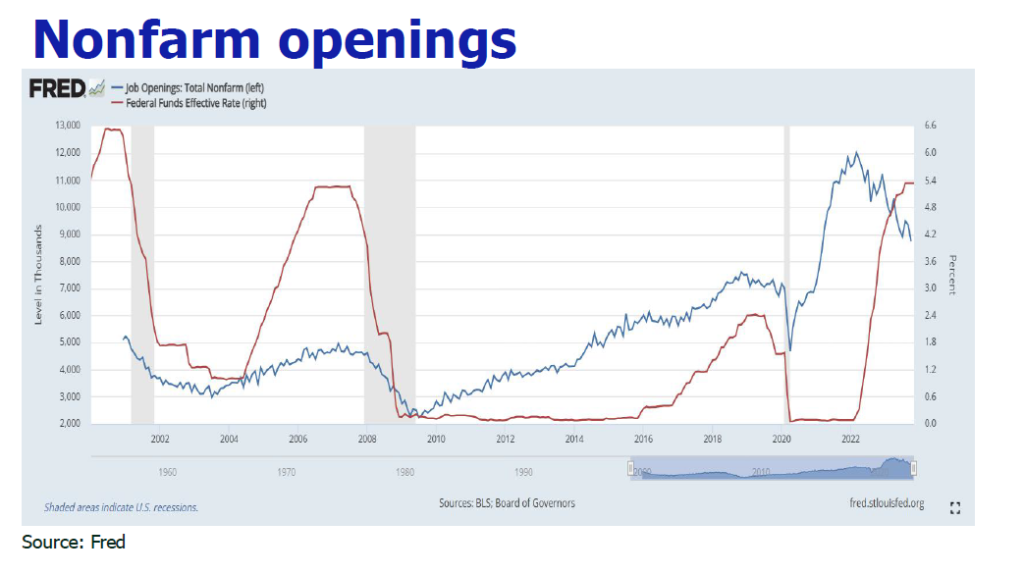

Labor market and consumer spending stay robust

The U.S. non-farm payrolls are expected to increase by 199,000 in November, while the previous value was 150,000. The return of auto workers helped increase the number by 30,000. Unemployment rate in November fell to 3.7% from 3.9% in October. Wage growth for the month was 0.4%, which was also

stronger than expected, and the labor participation rate increased slightly. U.S. retail sales in November increased by 0.3% from previous month, which was stronger than the 0.2% decline in October, while it the year on year growth was 4.1%. Although inflationary pressure persists, consumer spending continued to grow. As consumer expenditure accounts for as much as 70%-80% of U.S. GDP, the latest dataset indicated increased opportunities for a soft landing of the U.S. economy.

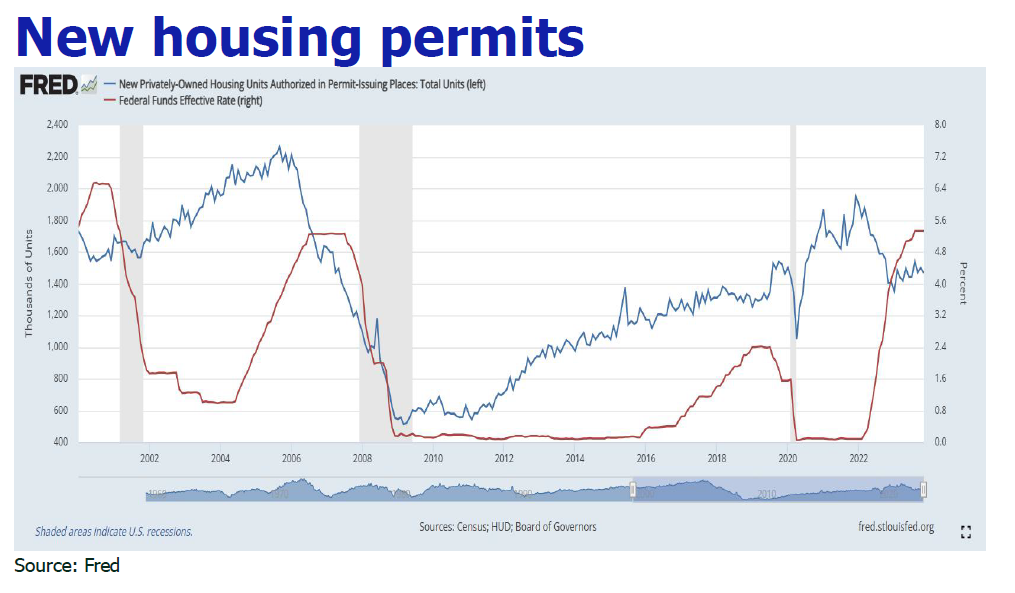

QT keep rolling and threaten economic growth

The Fed is currently reducing its holdings of U.S. Treasuries and mortgage-backed securities by $95 billion per month, bringing its bond holdings down from nearly $9 trillion last summer to the current $7.7 trillion. As the Fed shrank its balance sheet, the M2 money supply dropped from a record high of

$21.7 trillion in 2021 to $20.8 trillion in November. The Fed aims to shrink its balance sheet by another $1.5 trillion between now and mid-2025. A stagnant and even downsized money supply will threaten U.S. economic growth.

Prediction

1. Energy and commodity prices continued to brake inflation.

Oil price is expected to decline in 2024 due to slowdown of global economic activity and rising production in the United States (recently reaching a peak level of 13.24 million/day). On the other hand, the Fed’s rate hike measures have significantly increased the financing costs of consumers and businesses, which will suppress wage growth and consumer spending, leading to a decline in commodity prices. The Fed predicts that PCE and core PCE will drop to 2.4% next year.

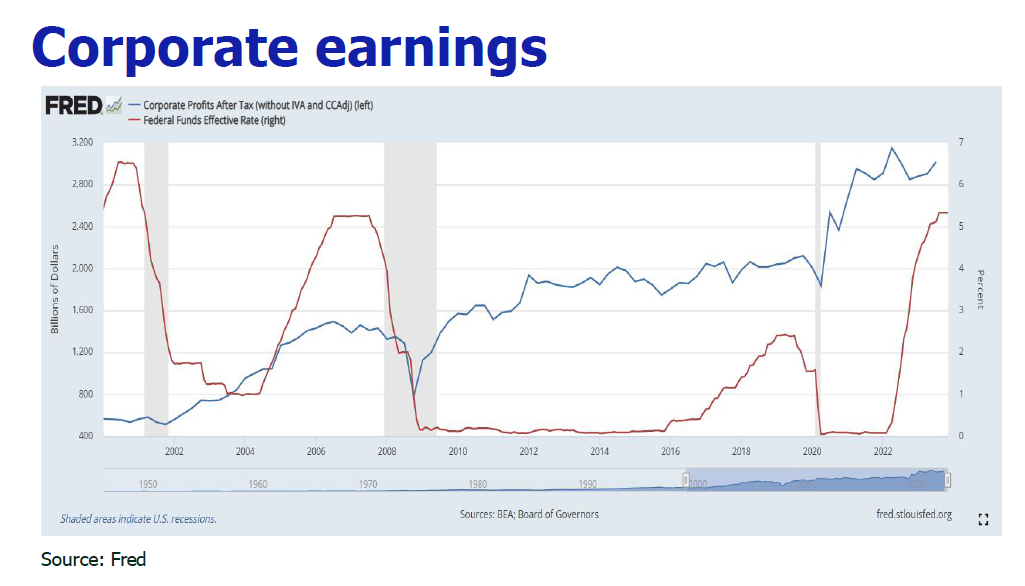

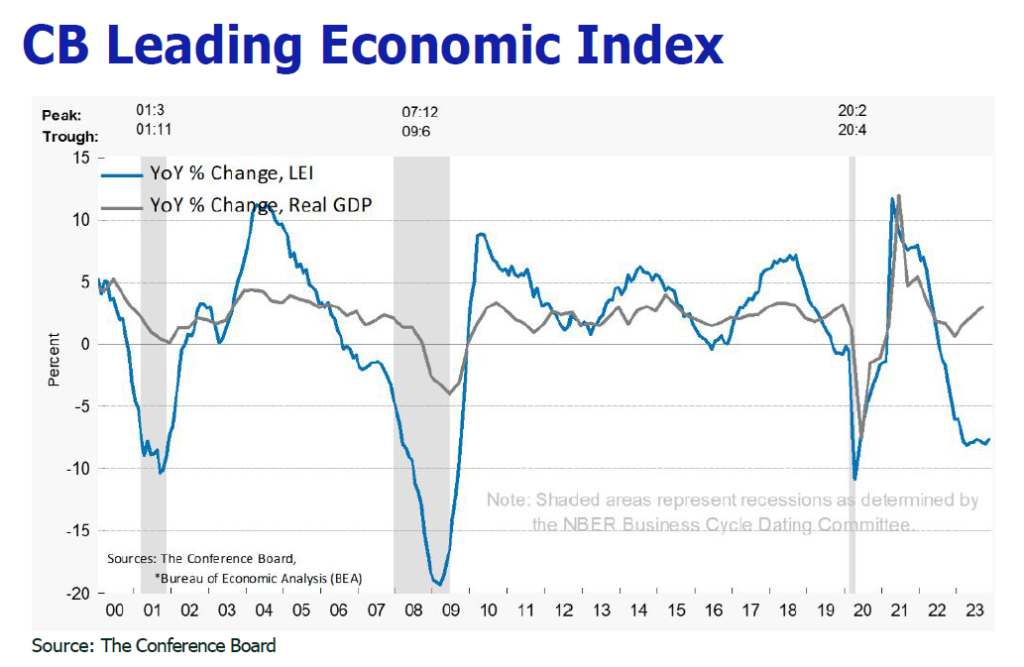

2. US economy growth to tumble.

The lagging effect of U.S. monetary policy has led to a contraction in credit scale, an increase in corporate interest expenses, a decline in investment growth, and a slowdown in industrial production, which will have a suppressive effect on consumption. The situation is exacerbated by the sheer government fiscal deficit. In the 2023 fiscal year ending on September 30, the federal government ’s fiscal deficit reached nearly $1.7 trillion, an increase of 23% from the previous fiscal year. The Treasury’s interest expenses contributed to the significant increase with $879.3 billion, an increase of US$161.7 billion from the previous fiscal year, accounting for more than 14% of the year’s net expenditures. In order to make up for the fiscal deficit, the size of the U.S. national debt will inadvertently grow, and the increase in interest payments will crowd out the government’s expenditure on other projects. The increase in government borrowing will also reduce the funds available for private investment and lead to an increase in corporate financing costs, dampening US economic growth. According to the OECD, U.S. economic growth will slow to 1.5% next year from 2.4% in 2023.

Disclaimer

All information used in the publication of this newsletter has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amountsnot yet determinable,

and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with theaccess to, use of or reliance on any information contained on this note.