A bumpy last mile refute early rate cut in March

Austin Or, CFA

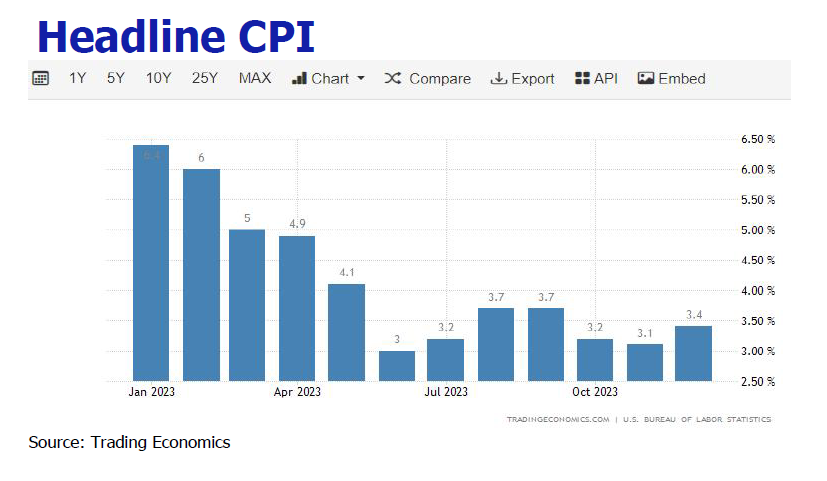

December CPI rebounded slightly, while core inflation displays a cooling trend

Data released by the U.S. Department of Labor showed that the U.S. CPI rose to 3.4% yoy in December of last year, higher than the market’s expectation of 3.2%, hiking from the previous value of 3.1%; with expanded mom increase to 0.3%, higher than the market’s expectation of 0.2% and went up from the previous value of 0.1%. Among them, gasoline prices rose by 0.2%, and electricity prices rose by 1.3%. Food prices increased by 0.2% on a monthly basis, the same as the previous month. In addition, shelter costs, which account for about one-third of the CPI, increased by 0.5% on a monthly basis, expanding by 0.1 percentage points compared to the previous month. After excluding the volatile food and energy prices, core CPI increased by 3.9% year-on-year, lower than the previous value of 4%, marking the lowest level since May 2021. The month-on-month growth rate remained unchanged at 0.3%. Despite the service CPI remains sticky, it is favorable to note that overall U.S. commodity prices have ceased to rise, and most goods, such as car prices, have entered a downward trend. As housing is a lagging indicator, it has not fully reflected the slowdown in rent growth in 2023. Changes in rent can only be seen when renewing leases or moving to new places. Thus, economists generally expect housing expenses to continue to decelerate but relatively slow, and the monthly growth rate of rents in the second half of the year is expected to be very close to pre-pandemic levels.

Non-farm payroll and wage growth beat expectations, mirroring tight labor supply

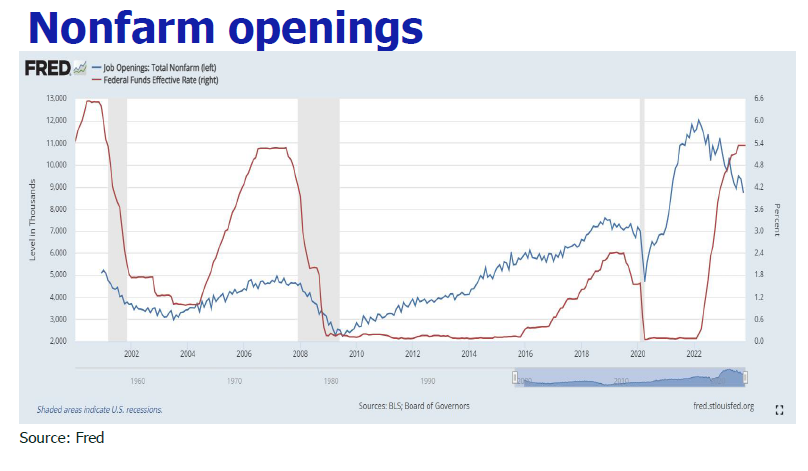

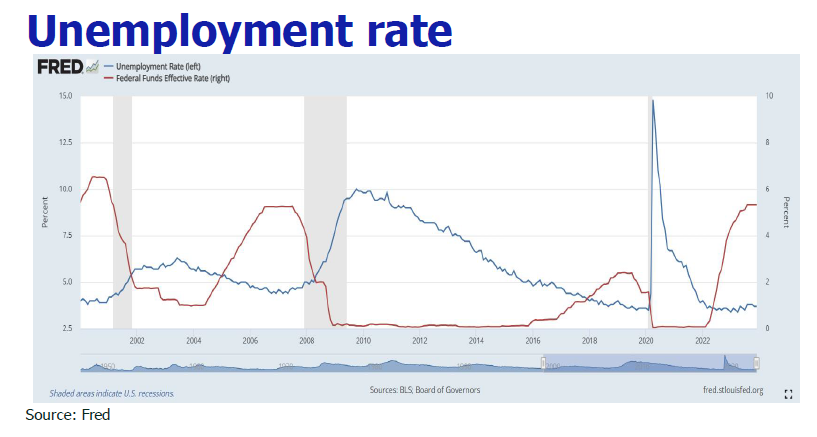

On January 4th, released ADP showed that private sector employment in the U.S. increased by 164,000 in December, surpassing the expected 115,000. On January 5th, non-farm employment in the U.S. increased by 216,000 in December, exceeding the expected 170,000. The growth in employment mainly came from the healthcare, government, construction, leisure, and hospitality sectors. Employment growth was mainly concentrated in low-interest-rate-sensitive sectors such as education and healthcare services (+74,000), government (+52,000), and leisure and hospitality industry (+40,000). These three sectors accounted for 77% of the December job growth in the U.S.. Currently, the employment situation in leisure, hospitality and government sectors are still relatively tight. The average hourly wage rate in the U.S. increased by 4.1% year-on-year in December, higher than the expected 3.9%. The unemployment rate in December recorded 3.7%, lower than the expected 3.8%.

Retail consumer spending is far from being busted

In December, retail sales in the United States increased by 0.6% month-on-month, which is double the previous value of 0.3% and surpasses the market’s expectation of 0.4%. It marks the largest increase in three months, with a year-on-year growth of 5.6%. Excluding automobiles, fuel, building materials, and food services, core retail sales increased significantly by 0.8%, the largest increase since July. Consumer spending accounts for about two-thirds of the U.S. economy, indicating that consumer spending may help drive economic growth this year.

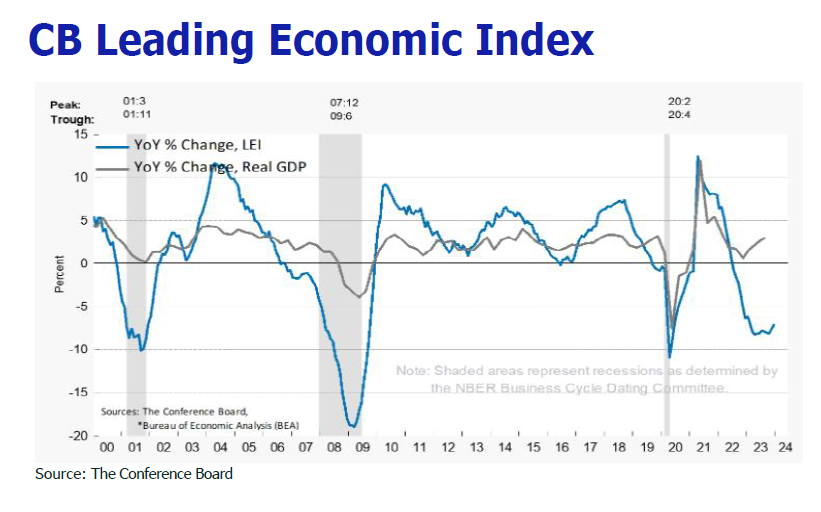

ISM exposed underlying economy weakness

Affected by a decrease in new orders, the ISM Manufacturing Index in the United States reported 47.4 in December of last year, marking the 14th consecutive month of contraction. However, the pace of decline has slowed down. The ISM Non-Manufacturing Index in the United States also dropped to 50.6 in December, marking the 14th consecutive month in the contraction zone and the second-lowest level of the year. It experienced a monthly decrease of 2.1 points, the largest decline since March. The employment sub-index plummeted to 43.3, reaching a new low since July 2020, highlighting the weakening momentum in the U.S. labor market. New orders also remained weak, with the new orders index dropping from 55.5 to the latest reading of 52.8, hitting a three-month low. This monthly decline of 2.7 points indicates a decline in demand outlook. The ongoing slowdown in the service sector will put US economic growth in peril.

Prediction

1. Employment growth will witness deceleration

As the rate-sensitive industry reduces new job openings, economists predict that the average monthly employment will increase by 64,000 people this year, which is less than one-third of the average of 225,000 people in 2023 and significantly lower than the 399,000 people in 2022. Due to employment growth being lower than labor force growth, economists expect the unemployment rate to rise from 3.7% in December 2023 to 4.1% in June and hit 4.3% by the end of the year, adding 1 million unemployment number to December last year.

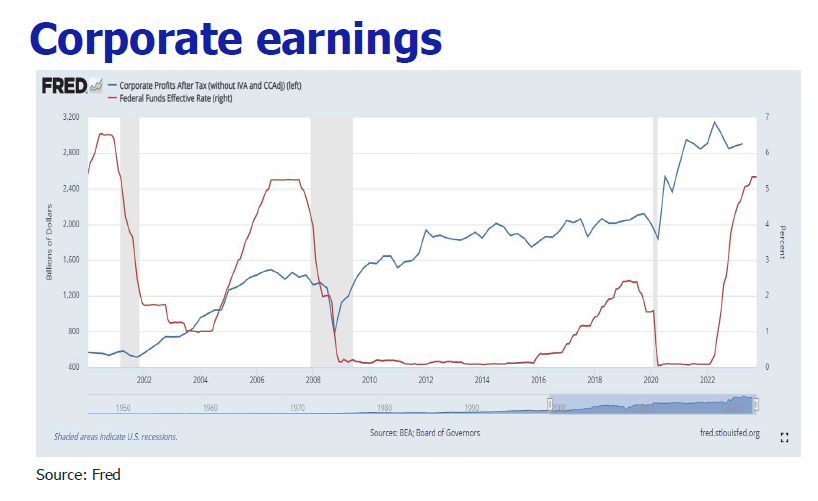

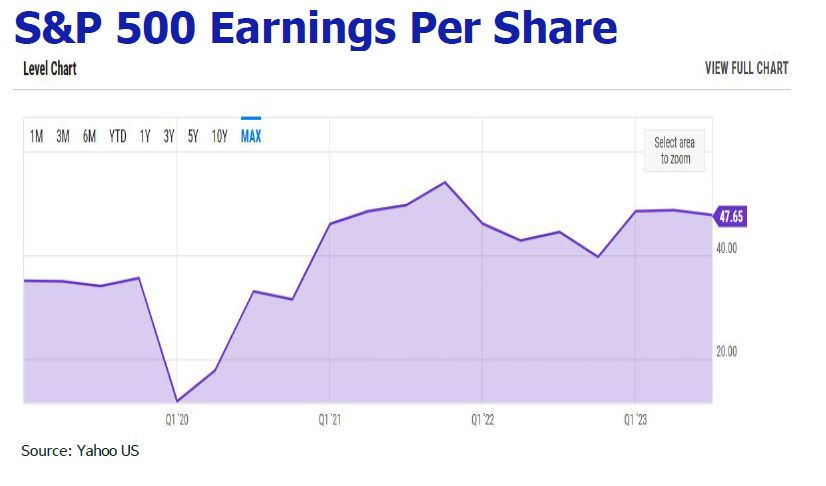

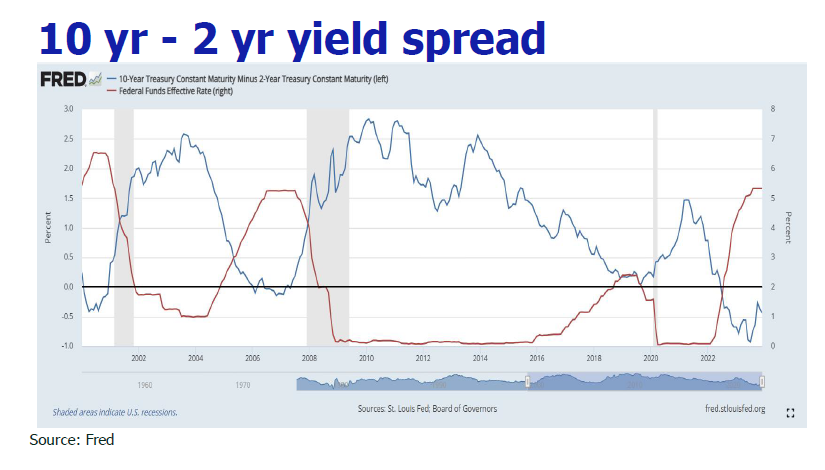

2. The rate cut should come later and smaller than the market consensus

The market widely anticipates that the Fed will make 4-6 rates cut by 100-150 bp to 4%-4.5% by the end of this year with the first rate cut initiating in March or May. However, the latest sticky CPI and strong nonfarm and retail figures support the soft landing theme for US economy and have greatly dispelled the likelihood of the timing of the first rate cut in March or May. Judging from the previous five rate cuts, we assert that the Fed rate minus core inflation differential has to exceed 2.9 bp before rate cut begins, meaning that the core inflation has to fall to 2.6% which is almost impossible to happen by March or even the first half of the year. As US economy remains resilient backed by strong employment and consumption, plus the worrisome liquidity crunch is not seen, sizable rate cut may refuel inflation and thus it is not the best option on the table. Majority of economists recently surveyed by Reuters opined that the first rate cut should take place in June and the magnitude of rate cut would be 100 bp or even less. Fed official also commented that the market’s rate cut expectation is too high. The wakening of false hope of Fed’s ambitious rate cut by the market would lead to more volatility of the capital market movement.

Disclaimer

All information used in the publication of this newsletter has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amountsnot yet determinable,

and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with theaccess to, use of or reliance on any information contained on this note.