Rate hike may have ended, and rate cut is on the way next year

Austin Or, CFA

The Fed made another paused of rate hike in November

At the November FOMC meeting, the Federal Reserve announced that it would suspend interest rate

hikes for the second consecutive time, keeping interest rates unchanged at a 22-year high of 5.25%-

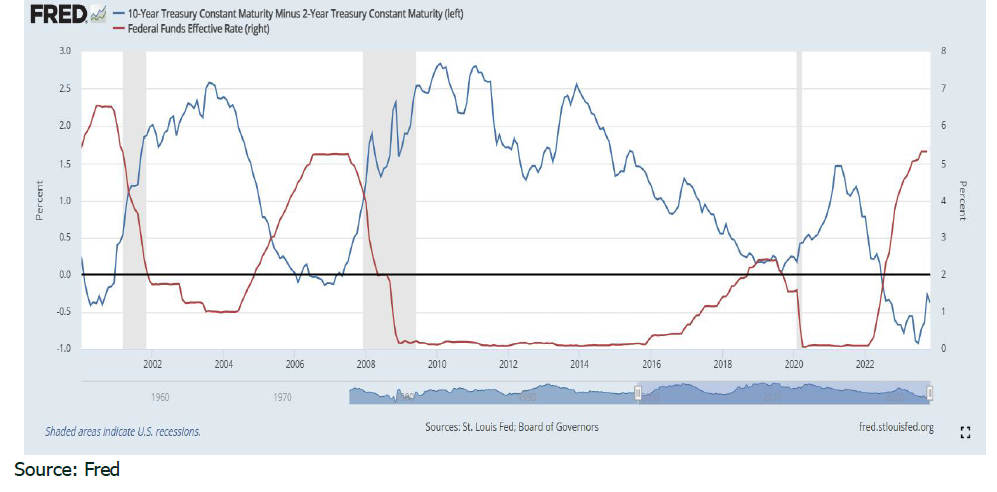

5.5% . The main reason for the pause in November is the rise in U.S. bond yields. Since the US

maintains high interest rates in order to suppress inflation, the U.S. government’s interest payments will

rise significantly, forcing the US to significantly increase the supply of medium- and long-term bonds to

repay old debts and interest. As of September, the total issuance of U.S. debt for the year reached

US$15.7 trillion, with net issuance of US$1.8 trillion, an increase of 45% compared to 2022. However,

as the largest buyer of U.S. treasury, the Federal Reserve, is gradually shrinking its balance sheet and

reducing its holdings of treasury bonds, while China and Japan, major holders of overseas official

investment institutions, are also disposing US treasury, the treasury yields were sent up. Since the

beginning of the year , the 10-year U.S. treasury yield has risen by about 40 basis points to about 4.3%.

The surge in U.S. bond yields will increase unrealized losses on ‘held-to-maturity’ and ‘for-sale’ bonds on

banks’ books, thereby tightening bank credit conditions and achieving the same economic tightening

effect of raising interest rates.

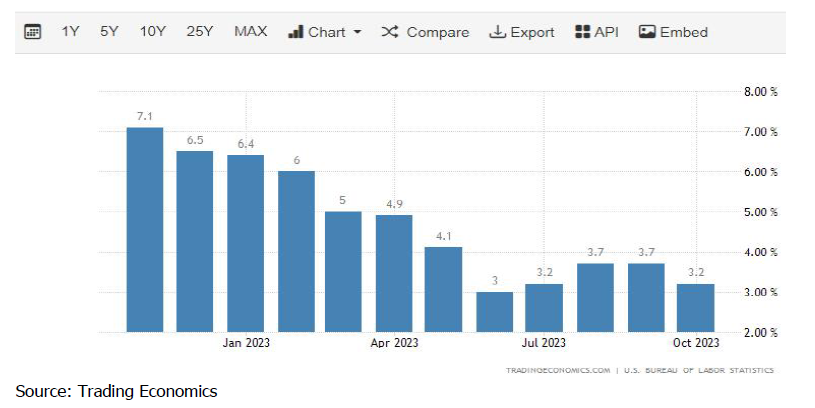

U.S. CPI and core CPI slowed to 3.2% and 4% yoy respectively

Data released by the U.S. Bureau of Labor Statistics on November 14 showed that the U.S. CPI

increased by 3.2% year-on-year in October, slightly lower than the market expectation of 3.3%, and the

previous value was 3.7%; the core CPI increased by 4.0% year-on-year, slightly lower than the 4.1%

market expectations whereas the previous value was 4.1%; CPI mom increased by 0% in October,

slightly lower than the market expectation of 0.1%, and the previous value was 0.4%. Both U.S. CPI

and core CPI inflation slowed down more than expected in October, mainly due to the fall in

international oil prices. Among consumer prices, energy costs experienced a 4.5% decrease, a

significant shift from the slight 0.5% reduction in September. Leading this decline were notable drops in

gasoline prices (5.3%), utility gas services (a steep 15.8% fall), and fuel oil (with a 21.4% decrease).

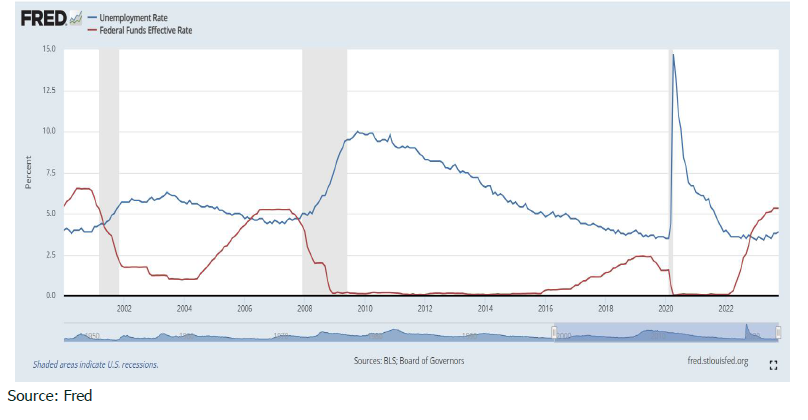

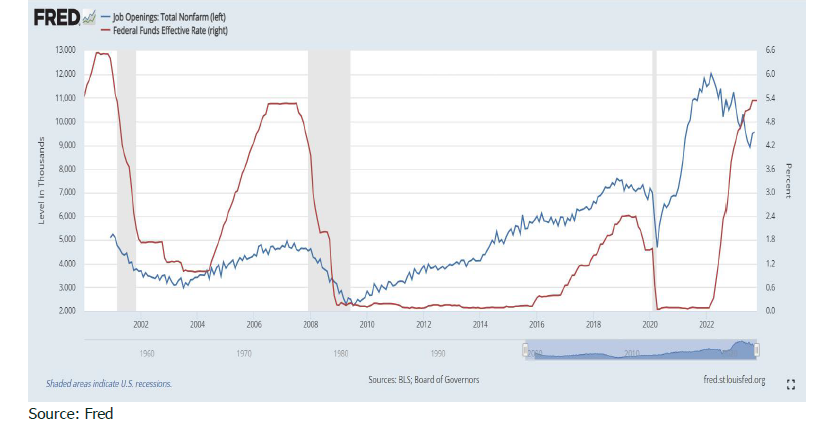

Strong employment and low debt burden support consumer spending

Notwithstanding the fact that the U.S. has raised interest rates to over 5%, the U.S. economy remains

resilient thanks to strong employment and consumption. Relative to pre-epidemic levels, job vacancies

in the United States are still increasing. Bureau of Labor Statistics data shows that there were 9.6 million

job vacancies in September, and there are still 1.5 vacancies for every person looking for a job. A large number of vacant positions and low unemployment rate continue to bring upward pressure on wages. In

the third quarter, the salary cost of white-collar employees increased by 4.3% year-on-year, and wage

increases remained higher than the inflation rate. The job market will continue to remain tight given

falling birth rates, reduced immigration and an increasing number of baby boomers approaching

retirement. On the other hand, the financial condition of American households is relatively healthy, with

only 60% of households having a mortgage, and 90% of them have interest rates of 4% or less.

Besides, households have a relatively low proportion of floating-rate debt, which moderates the impact

of higher interest rates on how much of their after-tax income is used to pay interest and principal.

Amid rising interest rates and high inflation, U.S. consumers continue to spend. According to FactSet

estimates, real personal consumption expenditure growth in the United States this year is 2.2%. Labor

markets are surprisingly strong. To put the economy on a path toward very weak growth or an outright

recession, greater damage to the labor market would be needed. As long as people believe they have

employment opportunities or feel secure about their jobs, they will continue to spend.

Signs of economic cooling surfacing

After the US recorded GDP growth of 4.9%yoy in the third quarter, a number of data in October showed

that the U.S. economy may be at a tipping point of cooling. There were 150,000 new non-farm payroll

jobs in October, lower than market expectations. The labor force participation rate was recorded at

62.7%, down 0.1 percentage points from September. Non-agricultural employment hourly wages

increased by 4.1% year-on-year and 0.2% month-on-month, both down 0.1 percentage points from

September. In addition, the U.S. unemployment rate has climbed to 3.9% from 3.5% three months ago.

Due to weak business activity and slowing employer hiring, the U.S. manufacturing PMI fell to 46.7 in

October beyond market expectations, and the ISM service industry expanded less than expected, hitting

the slowest pace in five months. Markit PMI data showed that the final value of the Markit service

industry PMI in the United States in October was 50.6, which was expected to be 50.9. U.S. retail sales

fell 0.1% in October from the previous month, the first decline since March this year. This represented a

rather steep slowdown from the previous revised value of 0.9%.

The cliff is approaching. The Federal Reserve Bank of San Francisco calculated in November this year

that cumulative excess savings since 2020 will exceed US$2.1 trillion when it peaks in August 2021. As

of September 2023, the total excess savings in the United States has consumed approximately US$1.7

trillion, leaving approximately US$430 billion. However, as the labor market further cools, wage growth

slows, and student loan repayments resume, the excess savings accumulated since the epidemic are

being depleted at an accelerated rate. U.S. Residents’ subsequent consumer credit is also declining. It is

expected that residents’ discretionary income will decrease, which will force them to reduce

consumption expenditure.

Prediction

- Rate hike pause to continue in December and the rate hike cycle may have ended.

Pressed by the high interest rates, inflation, employment growth, and consumer spending have begun to slow down. The U.S. GPD growth rate is expected to slow to 1.2% in 2023Q4. At the same time, the rise in

U.S. bond yields have resulted in additional tightening to the financial environment aside from rate hike.

Data from CME Group shows that the market currently expects a 94.5% chance that the rate will

remained unchanged at 5.25%-5.5% in December and a 5.5% chance of 25 basis points hike. Since

the current CPI is still far from the 2% target, the Fed does not rule out further rate hikes. However, it

can be seen that the previous rate hikes started to thwart the economy growth and will cause a

significant slowdown in Q4. Against this backdrop, CPI will continue to show a slowing trend, reducing

the need to raise rates. - Heading to rate cuts next year.

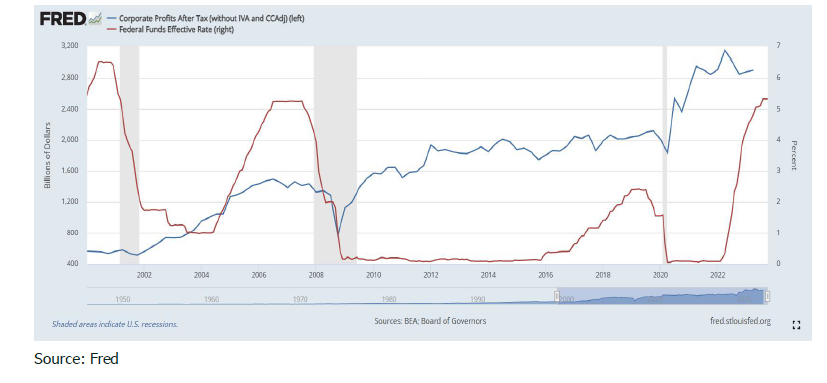

In the next few years, private companies and the US country

debt piles are growing to become dreadful. Goldman Sachs estimates the size of corporate debt maturing will reach $790 billion in 2024, $1.07 trillion in 2025, equivalent to 16% of all corporate debts,

and more than $4 trillion will come due between 2026 and 2030. If interest rates stand high, companies

will need to refinance at higher rates, leading to lower capital spending and job cuts.

On the other hand, the total size of the U.S. treasury debt currently reaches a record high of 33.6 trillion

U.S. dollars. As the United States continues to increase debt and interest rates, the annualized interest

expense on U.S. treasury debt is expected to exceed 1 trillion U.S. dollars by the end of October 2023.

About US$7.6 trillion of low-interest debt is expected to mature in the next 12 months, and with a deficit

of US$1.51 trillion-1.92 trillion in 2024, the net issuance of US debt next year is expected to be

approximately US$1.21 trillion-1.76 trillion, causing interest expenses to swell to US$115 million.

It is expected that the risk of corporate bond defaults and the pressure on interest payments on U.S.

treasury bonds will drive a policy shift by the Fed. The market generally expects the Fed to start cutting

rates in June or September 2024, and according to CME Fed Watch data, interest rates are expected to

fall by about 100 basis points by the end of 2024.

US Recession Tracker Dashboard

Corporate earnings

S&P 500 Earnings Per Share

10 yr - 2 yr yield spread

Unemployment rate

Nonfarm openings

Headline CPI

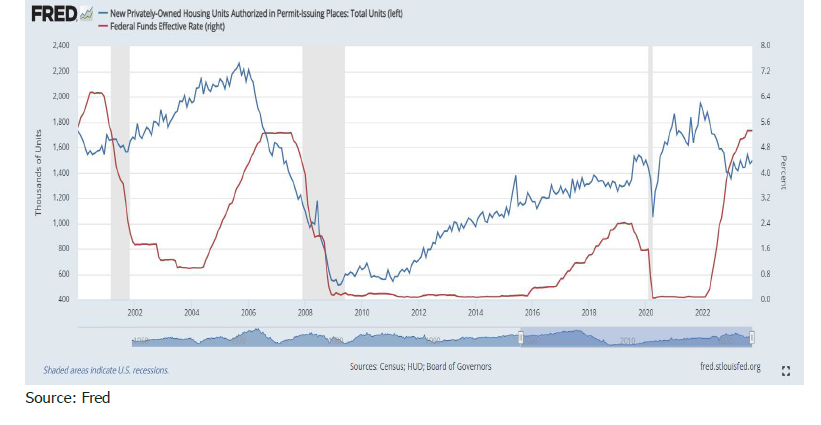

New housing permits

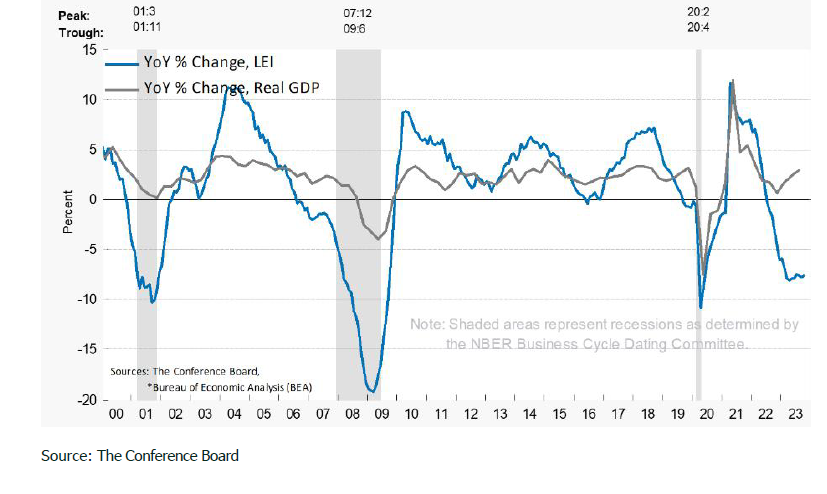

CB Leading Economic Index

Disclaimer

All information used in the publication of this newsletter has been compiled from publicly

available sources that are believed to be reliable, however we do not guarantee the accuracy

or completeness of this report and have not sought for this information to be independently

verified. Forward-looking information or statements in this report contain information that is

based on assumptions, forecasts of future results, estimates of amountsnot yet determinable,

and therefore involve known and unknown risks, uncertainties and other factors which may

cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages,

costs or expenses incurred or suffered by you arising out or in connection with theaccess to, use

of or reliance on any information contained on this note.