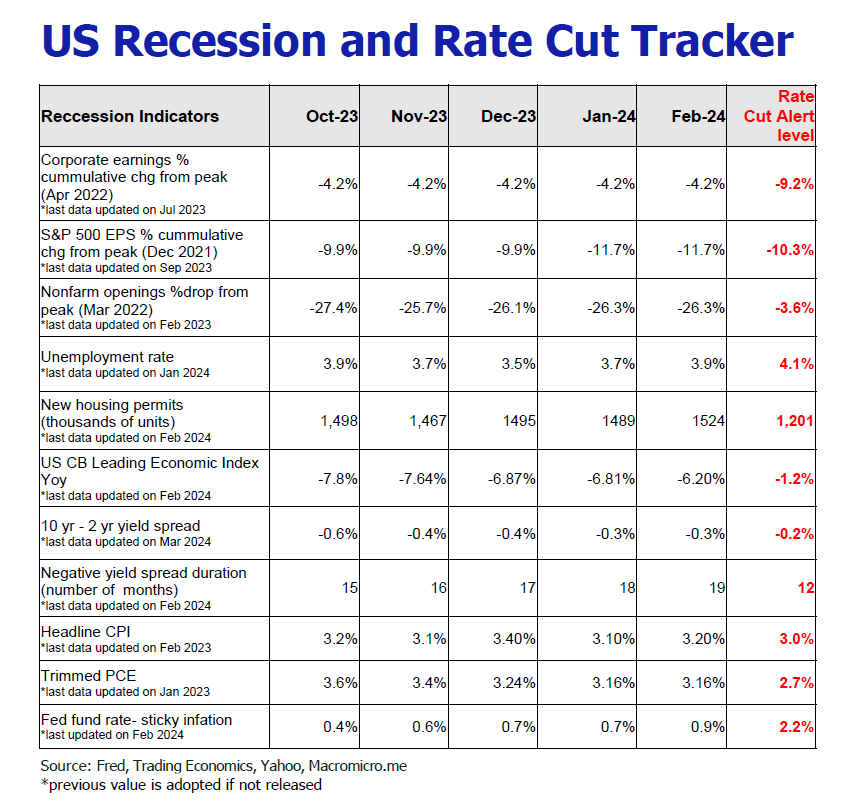

Fed reaffirms 75 bp rate cut expectation but timing is a question

Austin Or, CFA

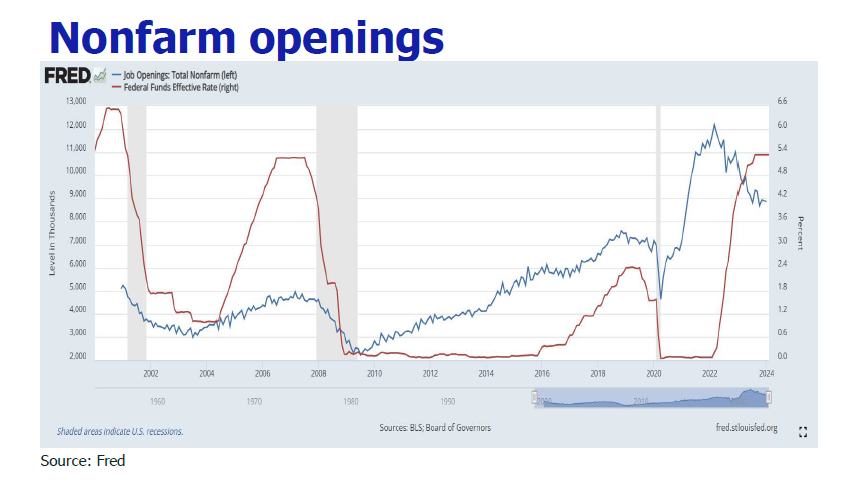

Seemingly bright but slowing non-farm payroll

The seasonally adjusted non-farm payrolls in the United States increased by 275,000 in February, the lowest since November 2023. Although it beat the market expectation of 198,000, it exhibited a significant decline compared with an increase of 353,000 in the previous month. Non-farm payroll in

December was revised down from 333,000 to 290,000, and that in January was revised down from 353,000 to 229,000. After these revisions, the combined non-farm payrolls in December and January decreased by 167,000, indicating a sign of slowing labor market.

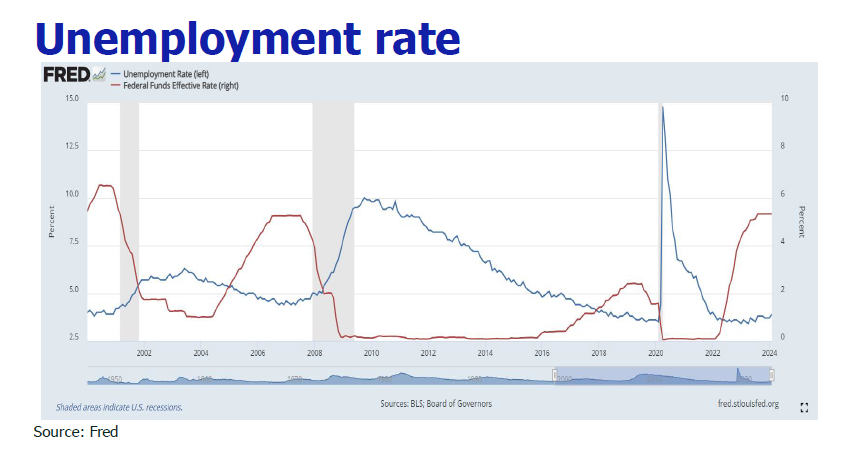

Mounting unemployment and tarnished wage growth

Unemployment rate shot up to 3.9% in February, higher than both the market expectations of 3.7% and the January print of 3.7%. U.S. companies plan to lay off 84,638 people in February, posting a 3%mom increase and a 9%yoy increase, reaching the highest level since the end of the global financial crisis in 2009. On the other hand, corporate recruitment plans are slowing down. Employers announced plans to hire 10,317 workers in February, the lowest number since 2009. According to the U.S. Bureau of Labor Statistics, average hourly earnings increased 4.3% yoy in February, coming below January’s 4.5% yoy wage growth; mom growth decelerated to 0.1%, also below the market expectation of 0.3% and the previous value of 0.6%.

Retail sales regained growth but missed expectation

U.S. retail sales increased 0.6% mom in February, rebounding after a sharp 1.1% mom decline in January, driven by growth in sales at car dealers and gas stations, but it fell short of the consensus increase of 0.8%. Continued growth in employee wages has elevated consumer spending, but momentum in retail sales is likely to diminish as wages growth declines, excess savings are depleted and reliance on borrowing increases.

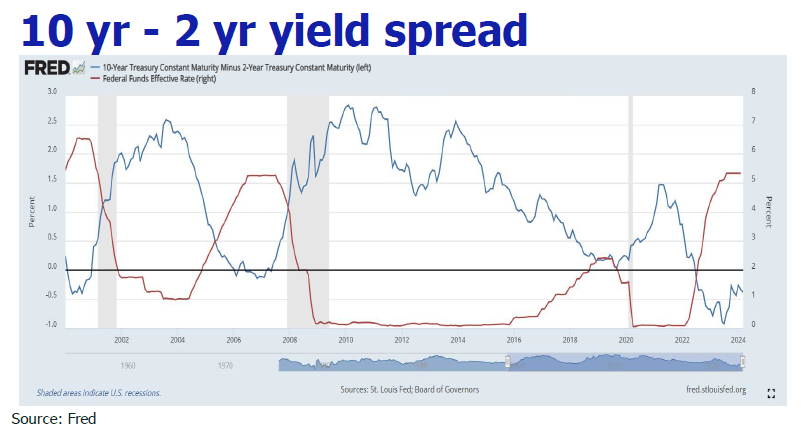

U.S. core inflation remained raging, culminating in more cautious rate cut attitude of Fed

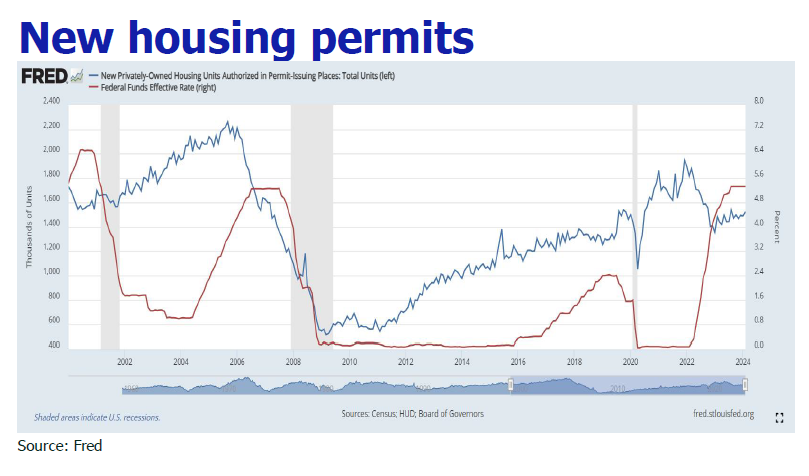

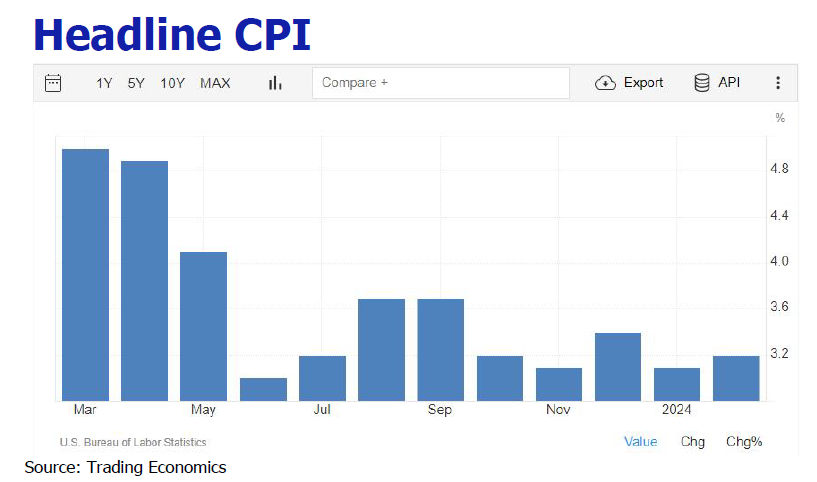

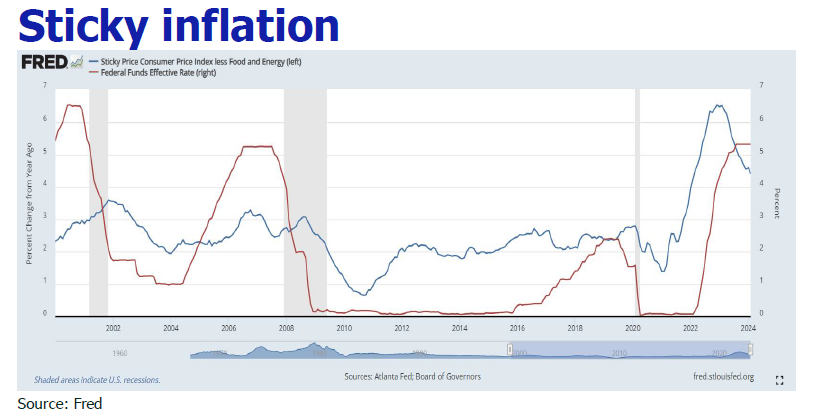

U.S. Department of Labor showed that February inflation continued to churn above 3% in February, exceeding expectations for the second consecutive month. February headline CPI, without seasonally adjustment, rose 3.2% yoy, coming higher than the expected 3.1%, and increased by 0.4% mom in line with expectations, but higher than the previous value of 0.3%. Shelter (including rent) and gasoline costs are the main villains for contributing more than 60% to the monthly CPI increase. The housing index increased by 5.7% year-on-year, accounting for about two-thirds of the annual increase in core CPI, and rose 0.4%mom after advancing 0.6% in the prior month. The gasoline index increased by 3.8% mom from -3.3% in January, and the yoy drop growing to -6.4% from -3.9% in January. Excluding volatile food and energy prices, the core CPI increased by 0.4% mom and 3.8%yoy, being worse than the corresponding market forecast of 0.3% and 3.7%. The super core CPI services index (excludes shelter and health insurance) weakened to 0.5% mom from 0.8% mom in the previous month. The stickiness of services-sector inflation suggests the Fed will have to wait until at least the summer to start lowering interest rates.

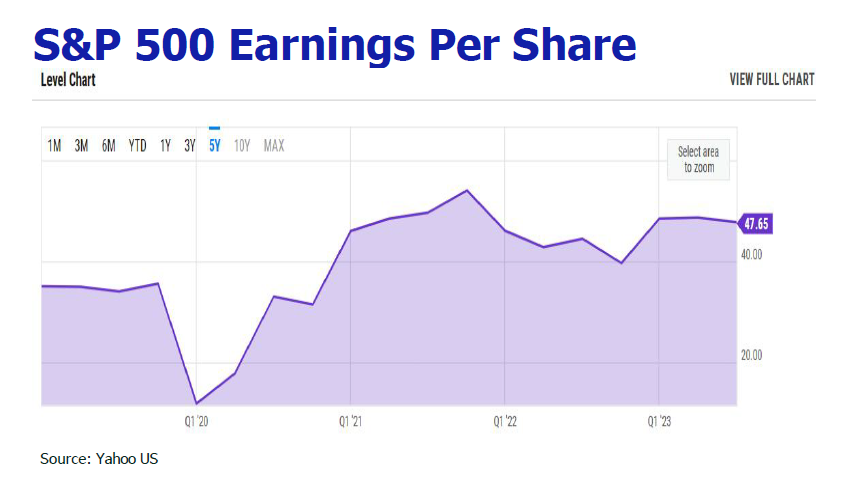

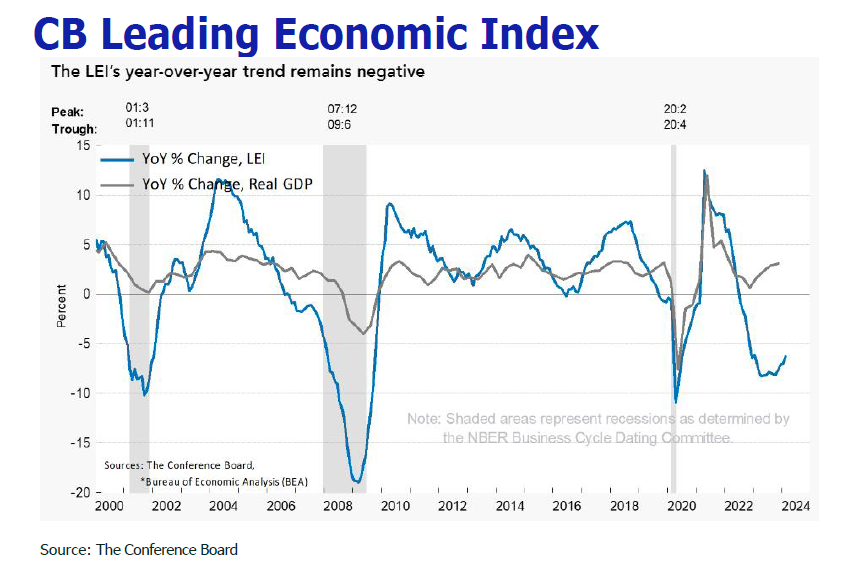

Fed raised core inflation and economic growth but trimmed unemployment forecast, still charting rate cuts this year

Fed announced after the FOMC meeting on March 20 that the target range for the federal funds rate is still 5.25% to 5.50%, stating that it is wary of rate cut before spotting strong and sustained easing evidence of inflation. In its latest summary of economic forecasts, the core PCE forecasts at the end of 2024 and 2025 are 2.6% and 2.2% respectively (vs 2.4% and 2.2% respectively in last December); the annual real GDP growth forecasts in 2024 and 2025 are 2.1% and 2.0% respectively (vs 1.4% and 1.8% respectively in last December); the interest rate forecasts at the end of 2024 and 2025 is are 4.6% and 3.9% respectively (same as December last year); the unemployment forecast for 2024 is lowered to 4% and 2025 foreast is still 4.1%. Echoing with Fed, Wall Street economists revised 1Q2024 U.S. GDP growth from 0.6% to 1.8%, and raised Q2 forecast rom 0.4% to 1.3%.

Prediction

1.Service inflation is primed for descent as nonfarm payrolls and housing costs are poised to slow.

Although the current non-farm employment is as high as 275,000, it is expected to plummet gradually to 100,000 by the end of this year drawing on Moody’s analysis, thereby weighing on inflation. As the shelter inflation (including rent) reflects a survey of thousands of units that is conducted only every six months, it is a lagging indicator. The Zillow Watch Rent Index, a more broad-based and realtime rental measure, was up 0.4% mom in February but recorded a 3.5% gain yoy versus the 5.7% in the CPI print. So, the latter service inflation is expected to ease in tandem with the Zillow Watch Rent Index, setting the stage for decline of inflation.

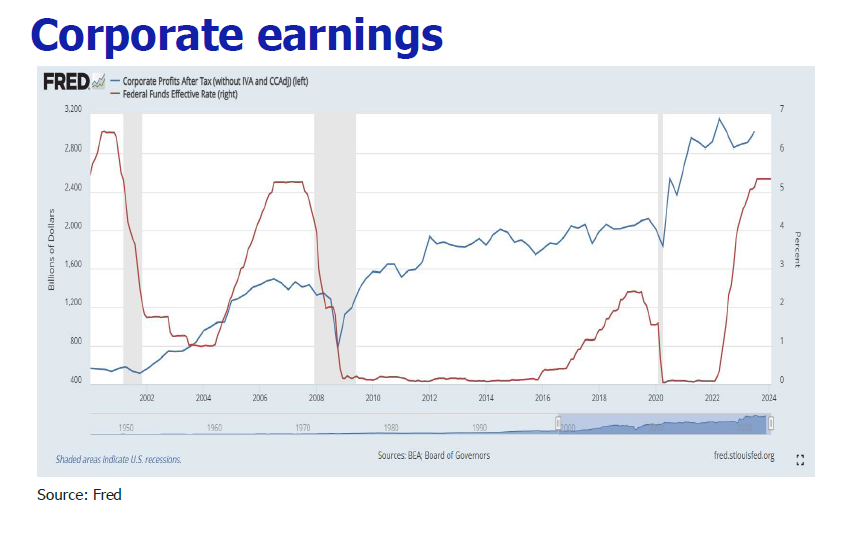

2.Hefty commercial real estate and corporate debt alert

The total size of US commercial real estate loans due in the next few years will be US$3.35 trillion, of which the US$544 billion and more than US$1 trillion in commercial real estate loan will be due in 2024 and 2025 respectively. Higher interest rates and tighter financial conditions have inhibited banks from financing riskier commercial real estate loans, and the National Bureau of Economic Research (NBER) warned that hundreds of banks could go bankrupt due to defaults on commercial real estate loans. If Fed lowers rate, the refinancing and bankruptcy risks can be alleviated. On the other hand, according to

Goldman Sachs, there will be US$790 billion and US$1.07 trillion corporate debts due in 2024 and 2025 respectively, amounting to 16% of the outstanding corporate debts, driving up corporate bankruptcy and unemployment in the near future. By Sahm Rule, if the recent three-month average of unemployment jumps by more than 0.5 percentage points from the previous low, US economy will enter into recession. At present, the SAM indicator has climbed to 0.27. Once the US unemployment rises above 4%, it will trigger Sahm Rule and prompt for rate cut.

3. Strong economic growth and labor market, and a precarious inflation path may lower and delay the Fed’s rate cut.

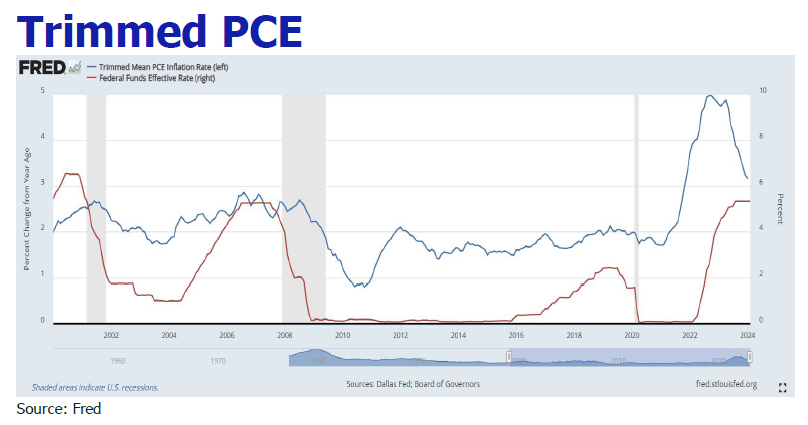

Referring to the last rate cuts in 2019, 2007 and 2000, they started 5-7 months ahead of recession. If US unemployment surges to 4% by the end of this year as projected and hits the recession threshold, it means that the Fed would potentially make the first rate cut in May – July this year. Alternatively, by looking at the trimmed PCE, it will have a chance to drop to 2.7% to trigger a rate cut coming to June or July. Historically, the number of new non-agricultural workers had to drop to around 100,000 to trigger rate cut. So, it is still far from reaching the bar. Although the market still bets on the first rate cut in June, the resilient labor market and upward revision of US economy make the cooling path of inflation more precarious, potentially postponing the rate cut to July or September, in our view. Judging from the more stubborn than expeccted inflation, it is unlikley to have a 75bp rate cut, and 25bp-65 bp rate cuts are projected in 2024, unless economic condition changes substantially.

Disclaimer

All information used in the publication of this newsletter has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amountsnot yet determinable,

and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with theaccess to, use of or reliance on any information contained on this note.