Heightened hope of soft landing but still at a crossroad with recession

Austin Or, CFA

More soothing inflation leads Fed signals no rate hike in September

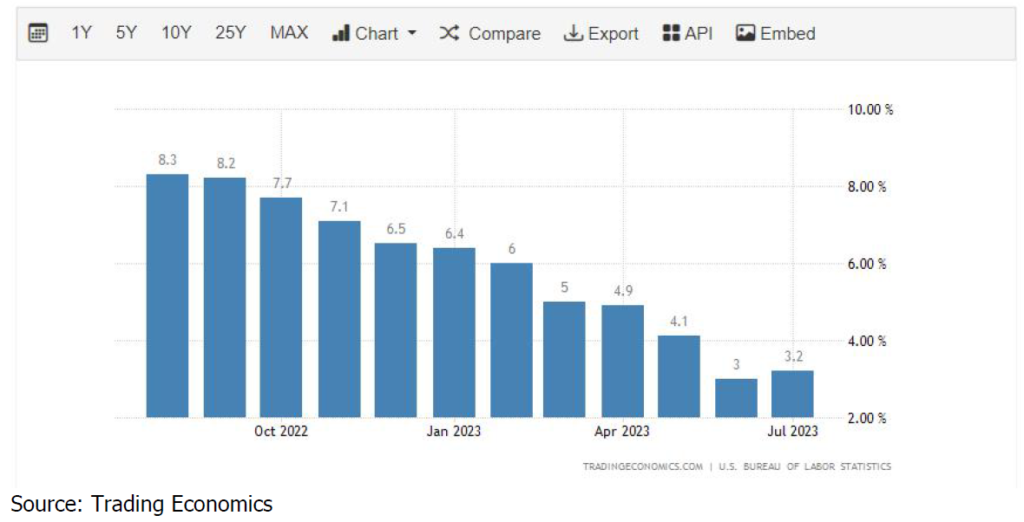

The U.S. consumer price index (CPI) rose 3.2% year-on-year in July, slightly higher than the 3% increase in June. Excluding volatile food and energy prices, core CPI rose 4.7% year-on-year in July, the lowest increase since October 2021. As the job market and inflation cooled, Federal Reserve Chairman Powell promised to “act cautiously” on raising interest rates at the central bank’s annual meeting in Jackson Hole in August, implying that a rate hike in September was no longer possible.

Unwavering labor market point to lower chance of U.S. recession

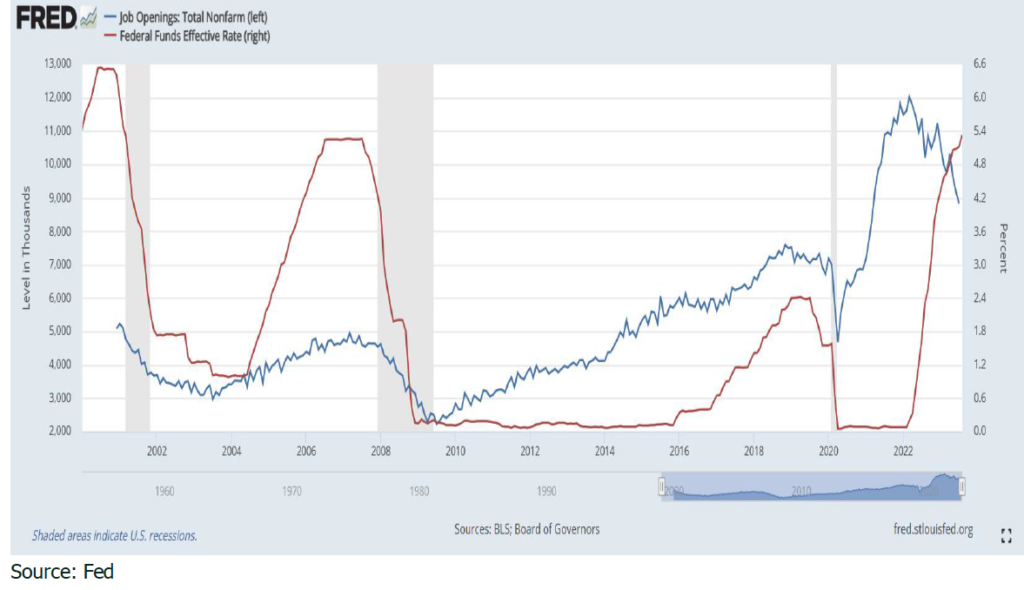

Despite the unemployment rate climbed to 3.8% caused by an increase in the employment participation rate and slower wage growth, the number of non-farm payrolls in the United States increased by 187,000 in August after seasonally adjustment, compared with the expeccted number of 170,000. Thanks to stable employment and strong consumer spending, as well as the U.S. Government’s unprecedented stimulus policies, the economy is still surprisingly resilient in the face of high interest rates. Slowing labor force growth and price increases have boosted Americans’ inflation-adjusted incomes this year, spurring more hiring and spending. The Labor Department revealed that employers added 3.1 million jobs in the past 12 months, including 187,000 in August. The government initially pumped cash into the economy and kept interest rates at rock-bottom levels, allowing businesses and consumers to lock in lower borrowing costs. Subsequent legislation, including “the Inflation Cutting Act” and the $53 billion “CHIP and Science Act”, further increased federal spending and spurred additional private sector investment in manufacturing.

Exhaustion of excess savings, loan repayments, and bankruptcy to weigh on economy

Since the beginning of the year, US consumers have had quite a strong disposable income owing to heavy consumption of their credit card spending and excess income. Unfortunately, that momentum has got waned, with data now showing consumers actively repaying credit card debt for the first time since COVID-19. JPMorgan Chase & Co. research in August warned that the huge economic boost from the excess saving has now been exhausted. The excess savings peaked at US$2.1 trillion in August 2021 and became -US$91 billion by June this year.

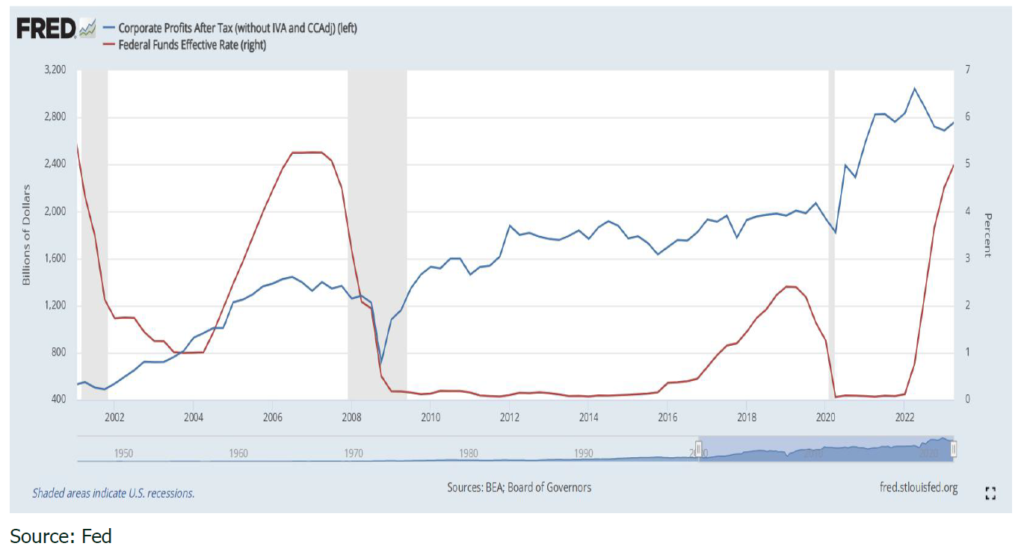

As the Federal Reserve continues to hike interest rates, the number of corporate bankruptcies in the United States increased by 54% year-on-year in August. In the first seven months of this year, a total of 402 corporate bankruptcies occurred in the United States, almost double the number of 205 in the same period in 2022, and close to the highest level since 2010. On the other hand, when corporate bonds gradually tend to fall in the next few years, the economy may go downhill, because companies that can obtain considerable low borrowing-rate funds have to obtain refinancing at higher rates. According to Fidelity, about a quarter of U.S. investment-grade bonds will mature between 2023 and 2025. After these bonds mature, they may face higher refinancing costs under the current high interest rate environment. Société Générale warns that the U.S. economy will fall into recession by mid-2024.

Looming soft landing expectation and mounting AI investment to drive corporate earnings

Statistics from investment institution Yardeni show that analysts generally expect that as the interest rate hike cycle approaches the end, the profit contraction trend starting from the end of 2022 is expected to end around the third quarter of this year. Starting from the third quarter of this year, the S&P 500 index’s overall operating profit per share began to recover and grew significantly in the fourth quarter, which in turn drove a rebound in 2023 profit expectations. Looking at a longer timeline,

analysts generally expect that operating profit per share in 2023 has begun to slowly recover from the previous negative trend, and is expected to regain a high growth rate of more than 10% in 2024, and is expected to achieve growth in 2025 Higher growth rate. On the other hand, Goldman Sachs’ forecast data on AI’s productivity improvements indicate that AI may increase the S&P 500’s average annual earnings per share (EPS) growth to approximately 5.4% over the next 20 years.

Prediction

- Oil price squeeze and UAW strike to push up inflation. According to Trading economics, August CPI forecast is 3.4%, a slight 0.3% gain compared to 3.1% in July. As Russia and Saudi Arabia decided to extend oil output cut to the end of 2023, Goldman Sacchs forecasts that Brent oil price may shoot up to US$107/b from US$90/b. A rough rule of thumb is that an unexpected 20% increase in crude oil prices will induce a 10% increase in gasoline consumer prices, and the CPI is expected to rise by an empirical increase of 0.3ppt. Since it takes about four weeks from an oil price increase to full-blown gasoline price increases, the recent rapid rise in crude oil prices will most likely be reflected in the CPI

data for September. Further, the UAW will likely impose a moratorium on all three automakers in Detroit

through the end of the month. That could dampen the economy for as long as it lasts and drive up

vehicle prices and CPI. - Suspension of rate hike in September and another 25bp in November. Federal Reserve officials will meet from September 19th to 20th. The futures market believes that the probability of not raising interest rates this time is over 90%, and the possibility of raising interest rates is only 8%. In the last two meetings of this year (November and December) , the probability of raising interest rates is about 40%. Judging from the latest pricing in the interest rate market, the possibility of the Federal Reserve raising interest rates in November jumped from 30% to about 45% overnight.

- U.S. GDP to grow by 3.7% in Q3, but face challenge at Q4 and recession 2024. The report released by the Institute for Supply Management (ISM) showed that the service industry purchasing managers index (PMI) increased by 54.5 in August to 52.7 since the new high in February 2023. This data exceeded the consensus forecast which drop slightly to 52.5 this year. Consumer spending was strong in June and July, so it now appears that economic conditions are actually shaping up for the third quarter. The U.S. economy is expected to grow by 3.7% or even 5% between July and September.

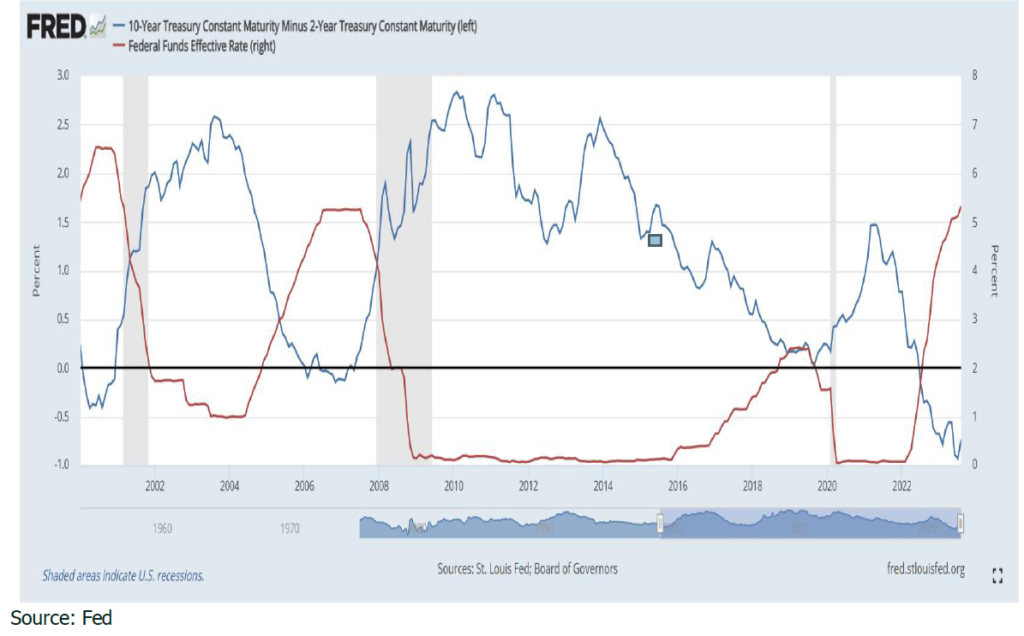

However, given that the excess savings are exhausted and other headwinds including higher gasoline prices, weaker consumption due to student loan payments and weakening labor market are looming, the market forecasts Q4 GDP may slow down to 0.5%. Bespoke Investment Group anticipates that the US economy will enter into recession in June 2024 at the average 589 days recession time taken between 1962-2019 after the yield curve of 10Y-3Y started to take place from October 2022. - S&P 500 will reach a higher level at year end. Improving corporate profits and the visibility of the end of the rate hike cycle are expected to provide upward momentum to the US stock market. The MD and senior portfolio manager of Morgan Stanley Investment Management predicts that the S&P 500 index may be “close” to 5,000 points by the end of 2023. Societe Generale strategists recently raised their year-end target for the S&P 500 index sharply from the expected 4,300 points to 4,750 points. Oppenheimer’s chief investment strategist raised his year-end price target for the S&P 500 to 4,900

from 4,400.

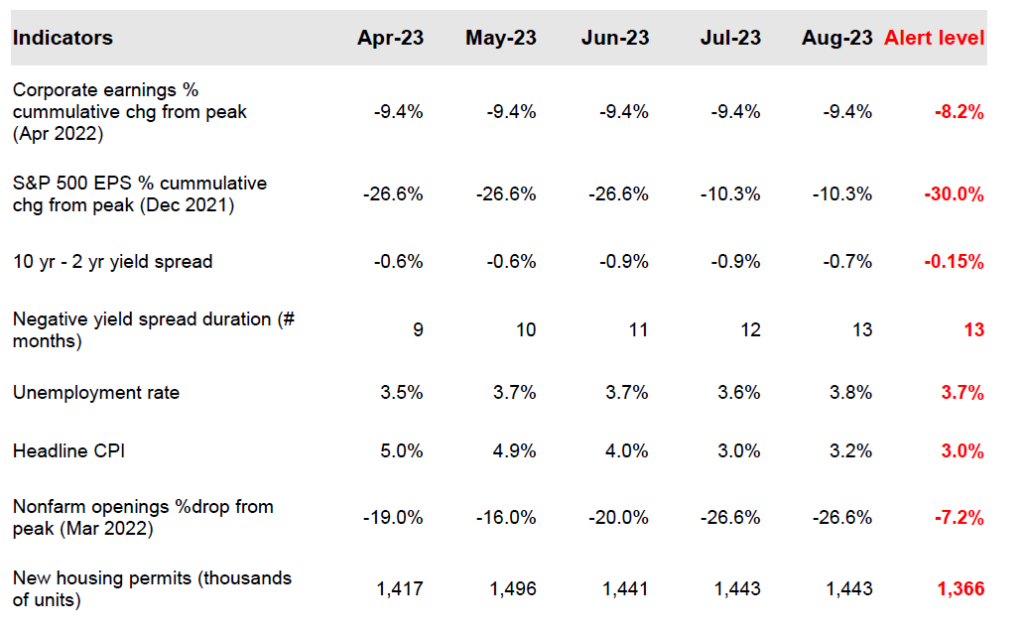

US Recession Tracker Dashboard

Corporate earnings

S&P 500 Earnings Per Share

10 yr - 2 yr yield spread

Unemployment rate

Nonfarm openings

Headline CPI

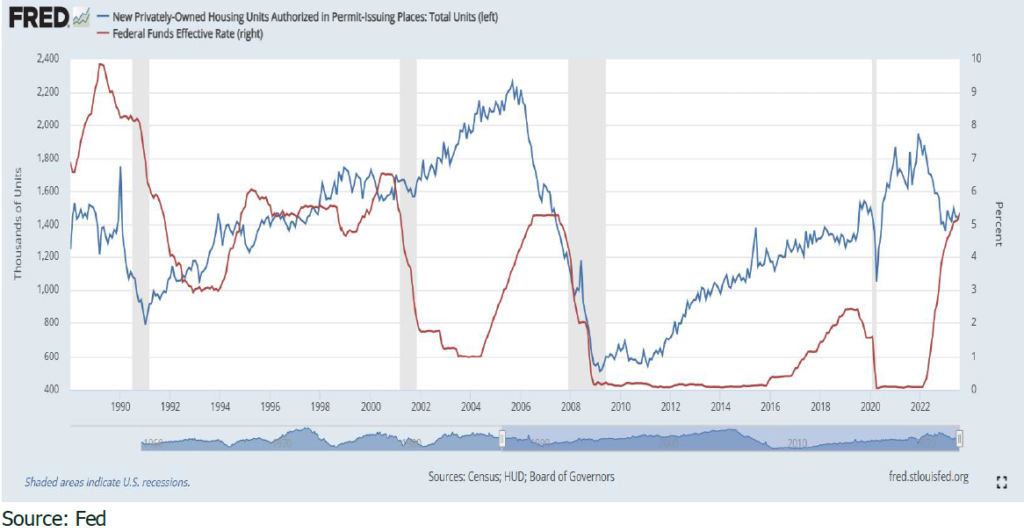

New housing permits

Disclaimer

All information used in the publication of this newsletter has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is

based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.