Tariff de-escalation averts recession edge and pushes back the rate cut timeline

Austin Or, CFA

Highlights

![]() April 2025 saw 177K new jobs, with steady unemployment (4.2%) albeit slowing wage growth (0.2% monthly), underscoring labor market resilience.

April 2025 saw 177K new jobs, with steady unemployment (4.2%) albeit slowing wage growth (0.2% monthly), underscoring labor market resilience.

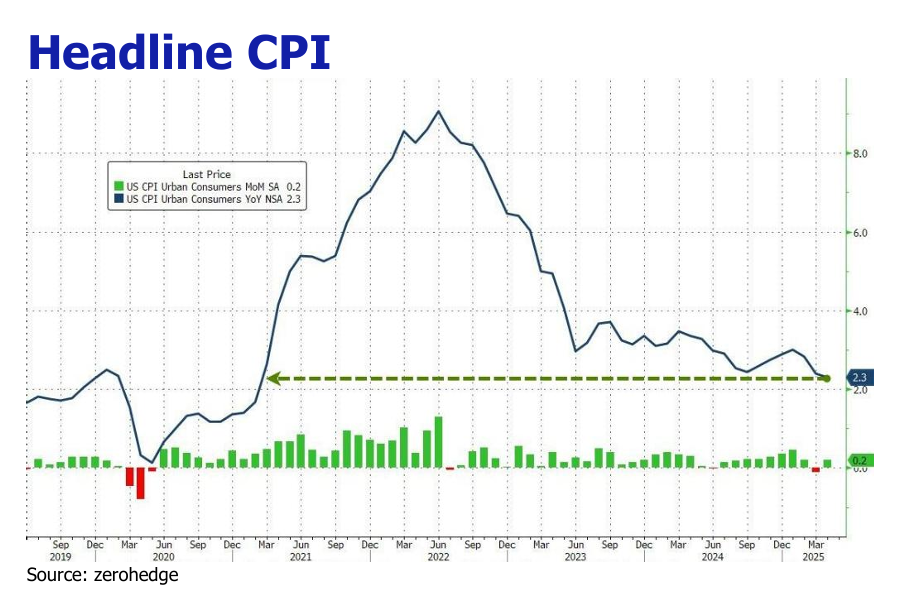

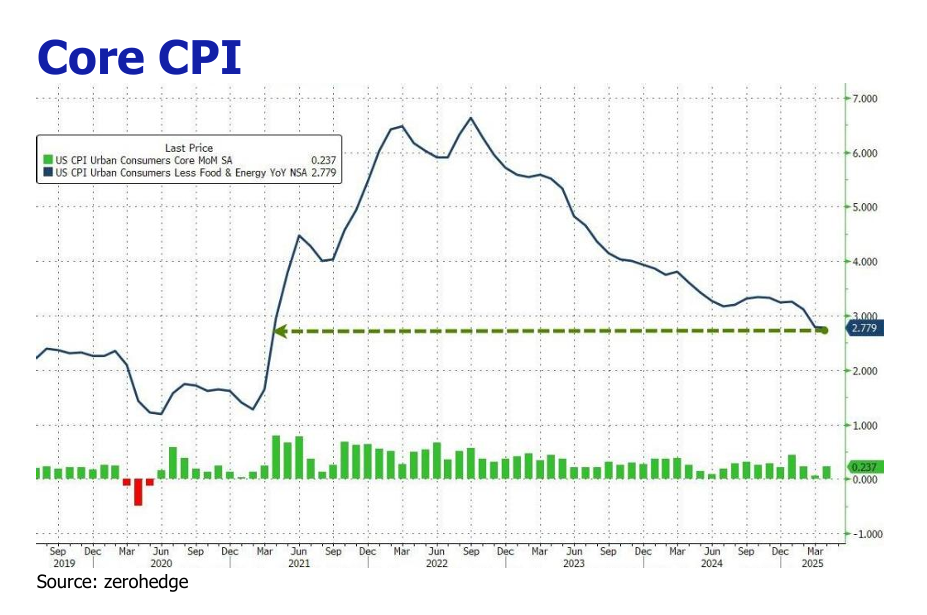

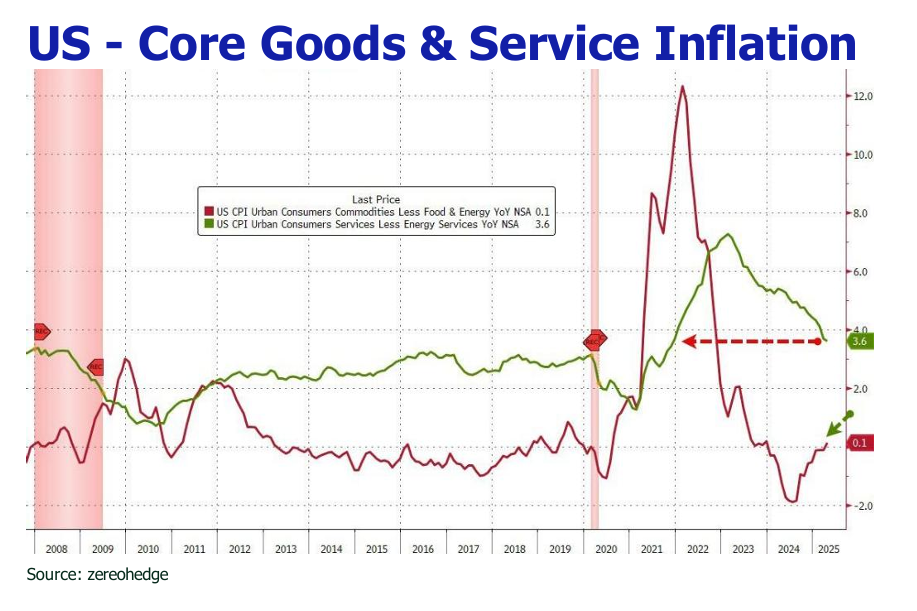

![]() Inflation eased slightly with April CPI rising 2.3% YoY (core CPI 2.8%), the lowest since 2021. Shelter costs drove increases, but “super-core” inflation (services ex-shelter) fell to 3.01%.

Inflation eased slightly with April CPI rising 2.3% YoY (core CPI 2.8%), the lowest since 2021. Shelter costs drove increases, but “super-core” inflation (services ex-shelter) fell to 3.01%.

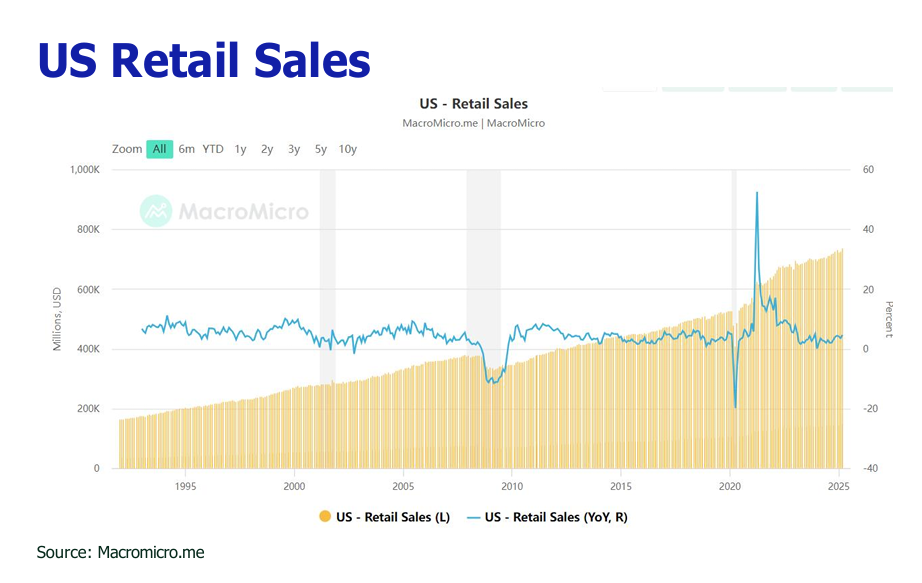

![]() April retail sales grew just 0.1%, down from March’s 1.7%, as tariff uncertainty dampened consumer spending, especially in autos.

April retail sales grew just 0.1%, down from March’s 1.7%, as tariff uncertainty dampened consumer spending, especially in autos.

![]() U.S.-China tariffs eased (30% from 145%), but new EU (50%) and Japan (10-25%) tariffs were imposed. A court blocked broad tariffs, complicating the tariff outlook.

U.S.-China tariffs eased (30% from 145%), but new EU (50%) and Japan (10-25%) tariffs were imposed. A court blocked broad tariffs, complicating the tariff outlook.

![]() The House approved a $5T tax cut, extending TCJA benefits (higher deductions, child credit, SALT cap) but worsening deficits, despite partial offset by $2.1T tariff.

The House approved a $5T tax cut, extending TCJA benefits (higher deductions, child credit, SALT cap) but worsening deficits, despite partial offset by $2.1T tariff.

![]() Ratecuts are expected to delay against prevailing call in June as tariffs may push core PCE inflation up 0.5-1%, plus strong labor market (4.2% jobless rate) reduces recession risk.

Ratecuts are expected to delay against prevailing call in June as tariffs may push core PCE inflation up 0.5-1%, plus strong labor market (4.2% jobless rate) reduces recession risk.

![]() US dollar is circling the drain (index down 6% from year peak) sowed by tariff volatility, rising deficits, and a Moody’s downgrade, pointing to to 12-19% total drop under rate cut scenario.

US dollar is circling the drain (index down 6% from year peak) sowed by tariff volatility, rising deficits, and a Moody’s downgrade, pointing to to 12-19% total drop under rate cut scenario.

![]() The U.S. debt, standing at $36 trillion or 123% of GDP, combined with rising refinancing costs (3.75% to 5.25%) and expanding deficits due to tax cuts, continues to exert significant pressure on the U.S. Treasury.

The U.S. debt, standing at $36 trillion or 123% of GDP, combined with rising refinancing costs (3.75% to 5.25%) and expanding deficits due to tax cuts, continues to exert significant pressure on the U.S. Treasury.

![]() Following a strong rally in May, the S&P 500 is expected to enter into a volatile period due to the interplay of improved sentiment from easing tariff tensions, reinforcement of the AI narrative, weaker household consumption, higher inflation, delayed rate cuts, elevated treasury yields and latest tariff uncertainty surrounding the US court ruling to halt most of Trump’s IEEPA-based tariffs.

Following a strong rally in May, the S&P 500 is expected to enter into a volatile period due to the interplay of improved sentiment from easing tariff tensions, reinforcement of the AI narrative, weaker household consumption, higher inflation, delayed rate cuts, elevated treasury yields and latest tariff uncertainty surrounding the US court ruling to halt most of Trump’s IEEPA-based tariffs.

![]() The HangSeng Index gained 6% to around 23400 with HK$200-300B daily turnover, under the confluence of China’s Monetary Stimulus (50 bp RRR and 10 bp 7-day repo rate cuts) and abated US-China trade tensions.

The HangSeng Index gained 6% to around 23400 with HK$200-300B daily turnover, under the confluence of China’s Monetary Stimulus (50 bp RRR and 10 bp 7-day repo rate cuts) and abated US-China trade tensions.

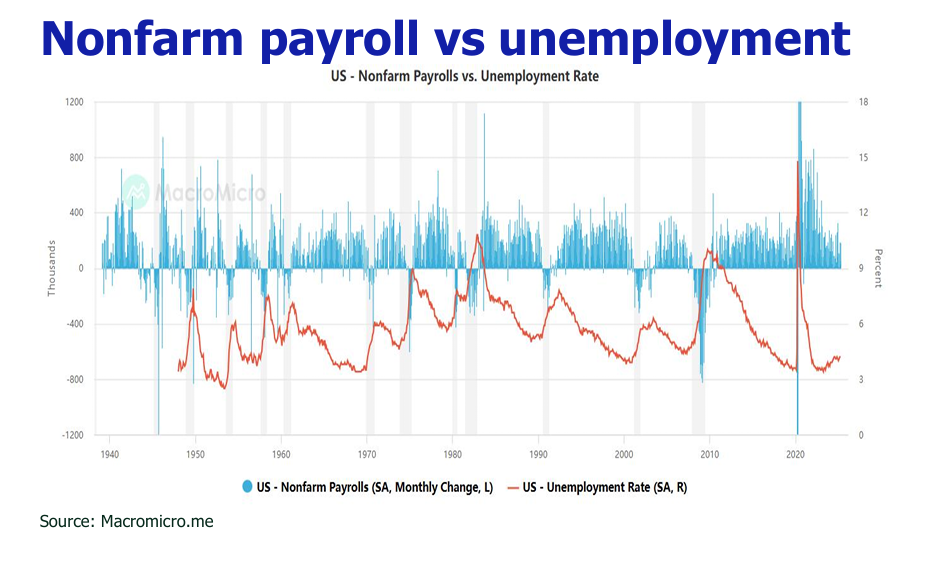

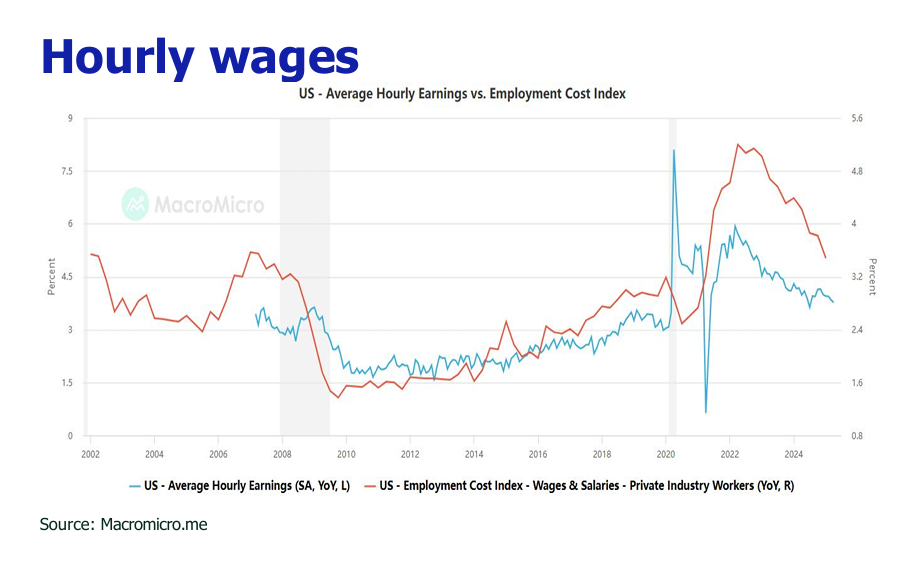

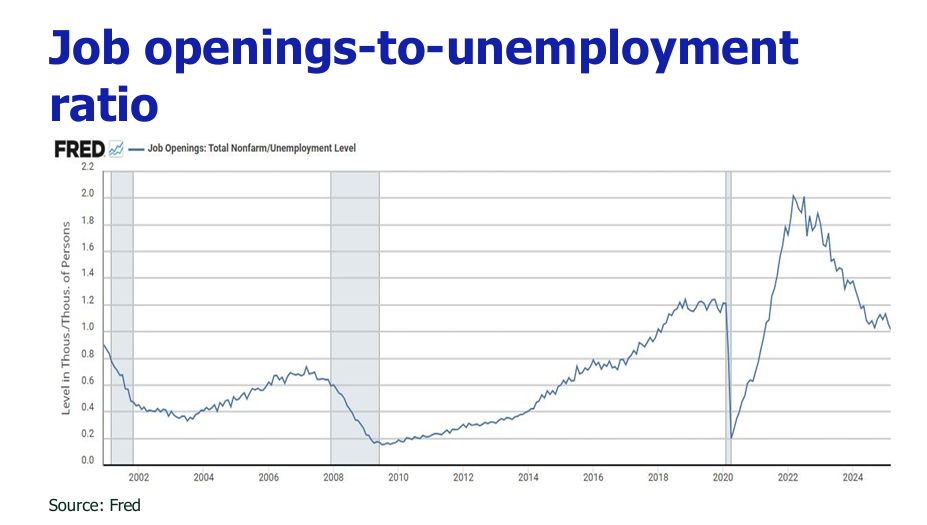

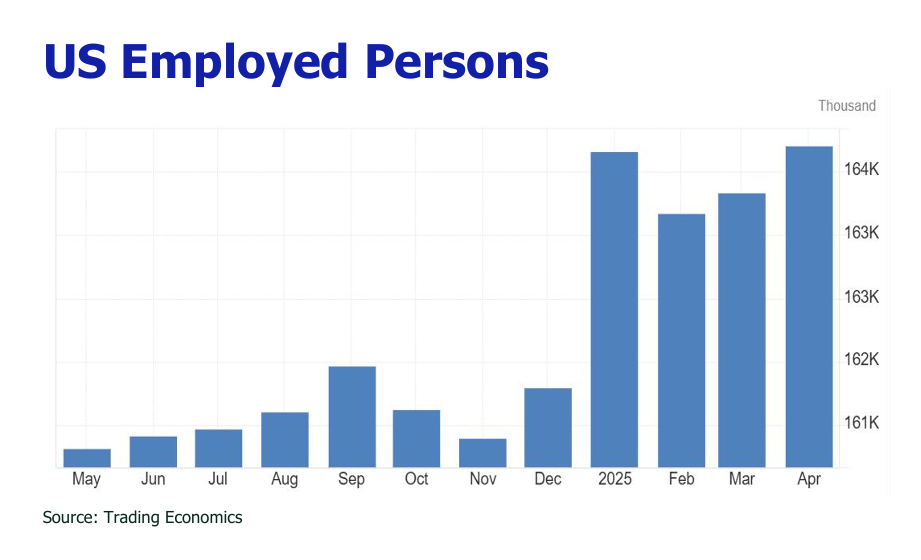

Labor market fortitude amid impending tariff disruptions

Despite apprehensions surrounding President Donald Trump’s sweeping tariffs on U.S. trading partners, April’s employment figures exceeded expectations. Nonfarm payrolls rose by a seasonally adjusted 177,000, marginally below March’s revised 185,000. Robust contributions from healthcare, transportation and warehousing, financial activities, and social assistance—totaling 94,000 jobs—offset a 10,000 decline in government and manufacturing roles. The unemployment rate held steady at 4.2%, aligning with forecasts and signaling labor market stability. However, average hourly earnings growth decelerated to 0.2% month-on-month and 3.8% annually, reflecting moderated wage pressures.

Reprieved inflation despite tariff pressures

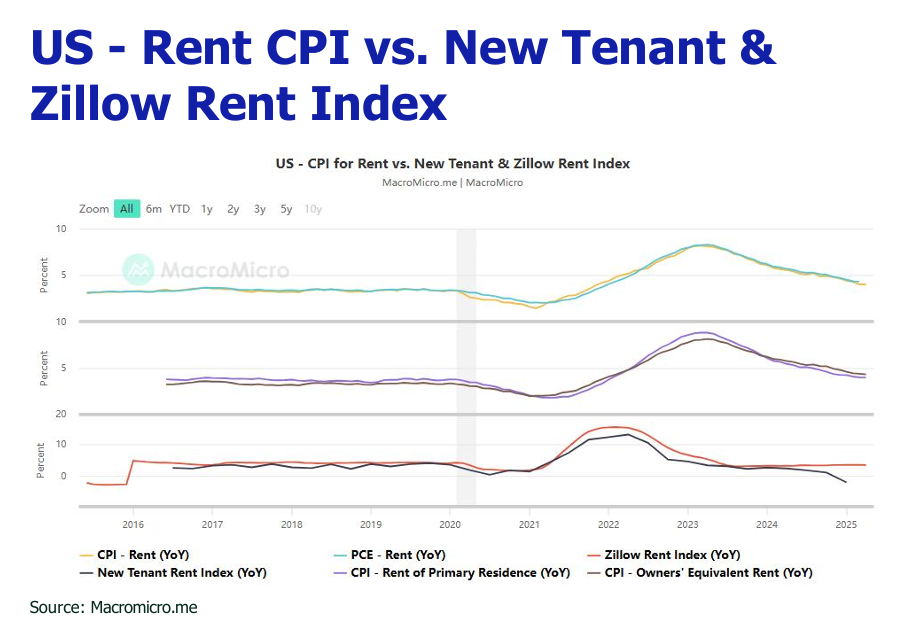

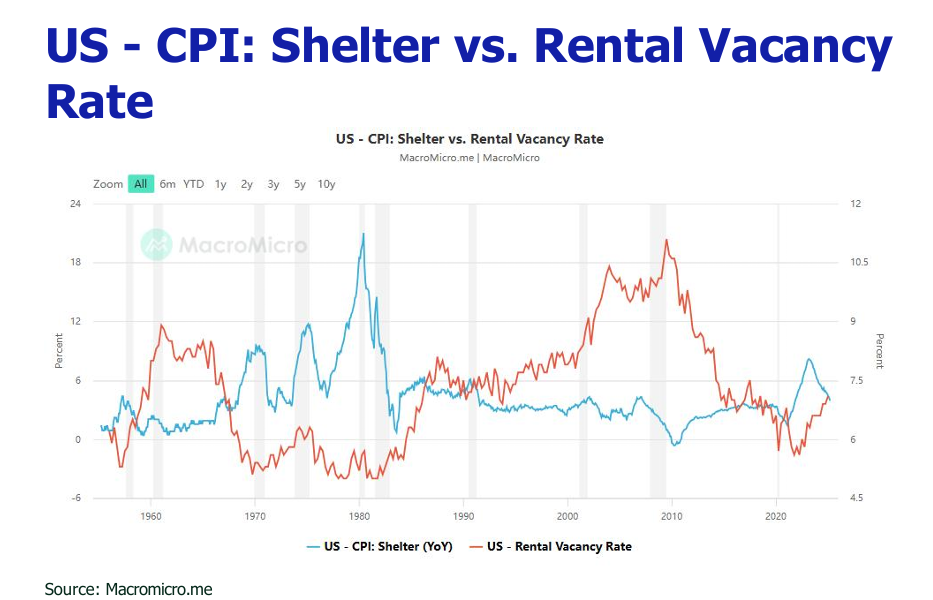

The U.S. Consumer Price Index (CPI) for April recorded a year-over-year increase of 2.3% (down from 2.4%), with a monthly rise of 0.2% (compared to a prior-0.4%). Core CPI remained steady at 2.8% annually, the slowest pace since the 2021 inflation surge, with a 0.2% monthly uptick (up from 0.1%). Shelter costs, constituting roughly one-third of the CPI basket, rose 0.3%, driving over half the index’s increase, per the Bureau of Labor Statistics. The “super-core” CPI (services excluding shelter) fell to 3.01% year-over-year, the lowest since December 2021, indicating easing inflationary pressures in select sectors.

Retail sales falter as tariffs curb demand

U.S. retail sales growth slowed markedly in April, with the pre-tariff surge in motor vehicle purchases waning and broader consumer spending contracting amid economic uncertainty. Retail sales inched up 0.1% following a revised 1.7% jump in March. Core retail sales—excluding automobiles, gasoline, building materials, and food services—declined 0.2%, after a 0.5% gain in March, underscoring tariff related demand suppression.

Tariff dynamics: de-escalation, escalation and invalidation by court

On May 12, 2025, a 90-day accord reduced U.S. tariffs on Chinese imports from 145% to 30%, prompting China to lower retaliatory tariffs on U.S. goods from 125% to 10%. The U.S. also adjusted the “de minimis” tariff on low-value Chinese shipments from 120% to 54%, effective May 14, 2025, with a $100 flat fee retained. Conversely, President Trump announced a 50% “reciprocal” tariff on European Union imports, effective June 1, 2025, up from a paused 20% rate. Japan faces a 10% baseline tariff on all exports, 25% on autos and auto parts, and 25% on steel and aluminum, with a 14% Japan-specific tariff paused until July 2025, pending negotiations. Additionally, steel tariff will be raised from 25% to 50%, effective June 4 2025.

Dramatically, a U.S. trade court blocked President Donald Trump from imposing sweeping tariffs on imports within 10 days under an emergency-powers law (IEEPA), disrupting Trump’s strategy to use tariffs as leverage in trade negotiations with countries like China, the EU, and Japan, potentially weakening U.S. bargaining power. That said, the Trump administration’s appeal to the U.S. Court of Appeals for the Federal Circuit, and potential escalation to the Supreme Court, creates ongoing uncertainty. Businesses may delay long-term investments until the legal outcome is clear.

U.S. tax cut extension spurs economic growth but widens deficit

On May 22, 2025, the U.S. House passed a tax cut bill (215-214), permanently extending the 2017 Tax Cuts and Jobs Act’s individual and estate tax cuts. The legislation raises the standard deduction to $26,000 for joint filers (2025–2028), eliminates personal exemptions, increases the Child Tax Credit to $2,500 (2025–2028), raises the SALT deduction cap to $40,000, and boosts the qualified business income deduction to 23%. It also repeals the 2022 Inflation Reduction Act’s clean energy credits. The Trump Administration claims $1.6 trillion in direct spending cuts will drive growth, generating $2.5 trillion in new revenue over a decade. The Tax Policy Center projects a $5 trillion tax cut over 2025 2034, with a 0.8% long-term GDP increase but a $2.6–$5.7 trillion deficit rise, partially offset by $2.1 trillion in proposed tariffs.

Rescission of AI diffusion rule and $2.2T AI investment by Middle East boost AI optimism

The rescission removes export restrictions, allowing companies like Nvidia, AMD, and Intel to sell advanced AI chips (e.g., Nvidia’s H100, B200) to a broader global market, including Middle Eastern countries previously restricted under Tier 2. Middle Eastern countries, particularly the UAE and Saudi Arabia, are reportedly investing $2.2 trillion in AI by 2025, focusing on infrastructure like data centers and AI campuses.The $2.2 trillion investment creates a massive market for U.S. chipmakers (Nvidia, AMD) and cloud providers (Microsoft, Amazon). The Middle East’s investment strengthens U.S. AI dominance by aligning with American standards and infrastructure, as opposed to Chinese alternatives.

Prediction

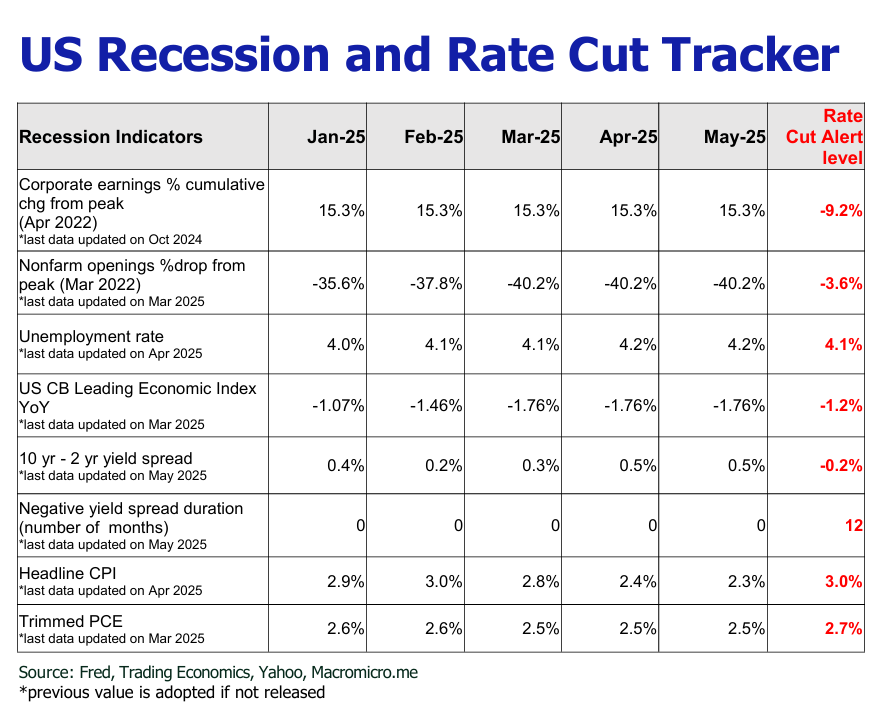

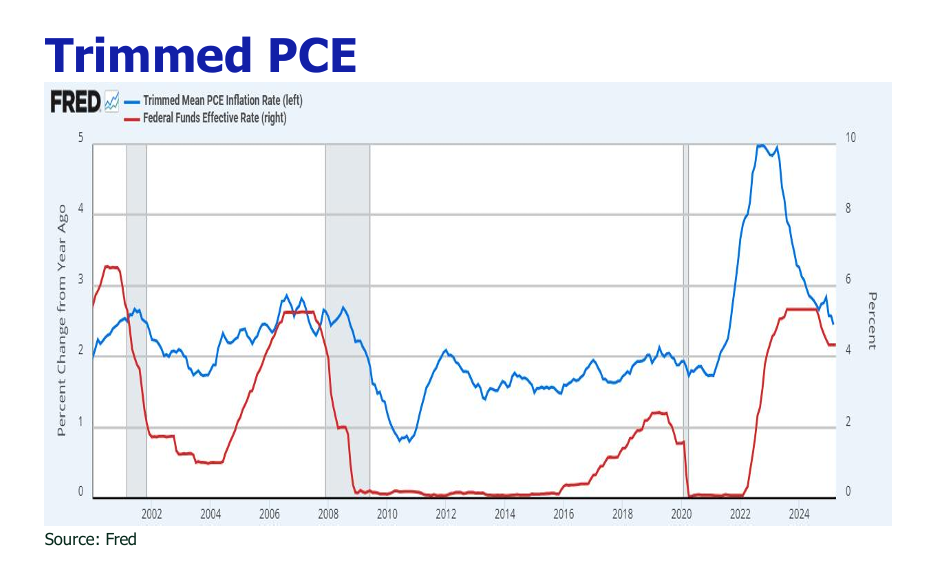

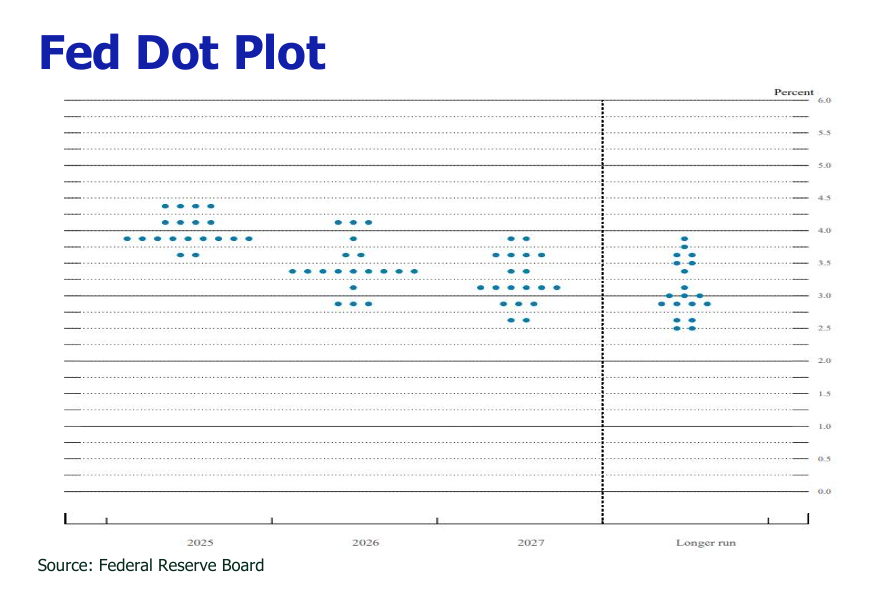

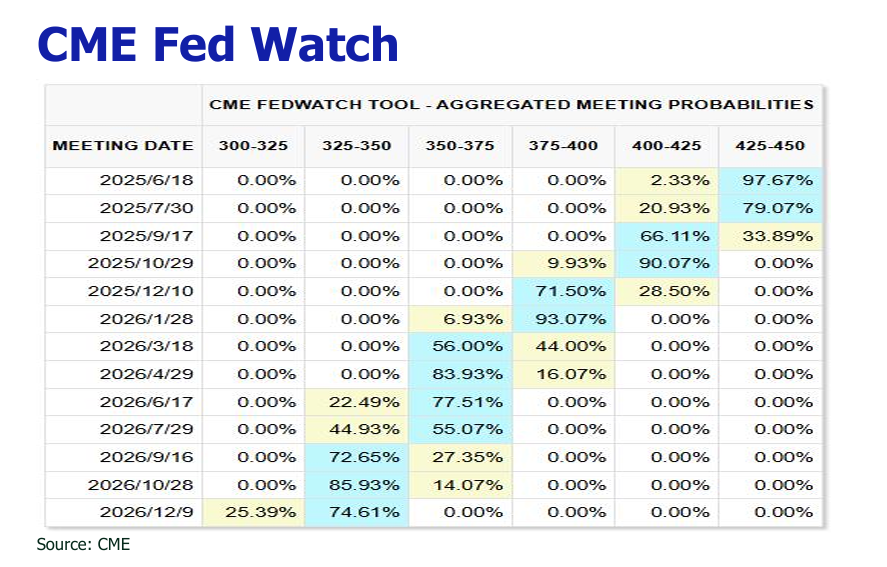

1.Tariff-induced inflation and sturdy labor market dim prospects for near-term rate cuts.

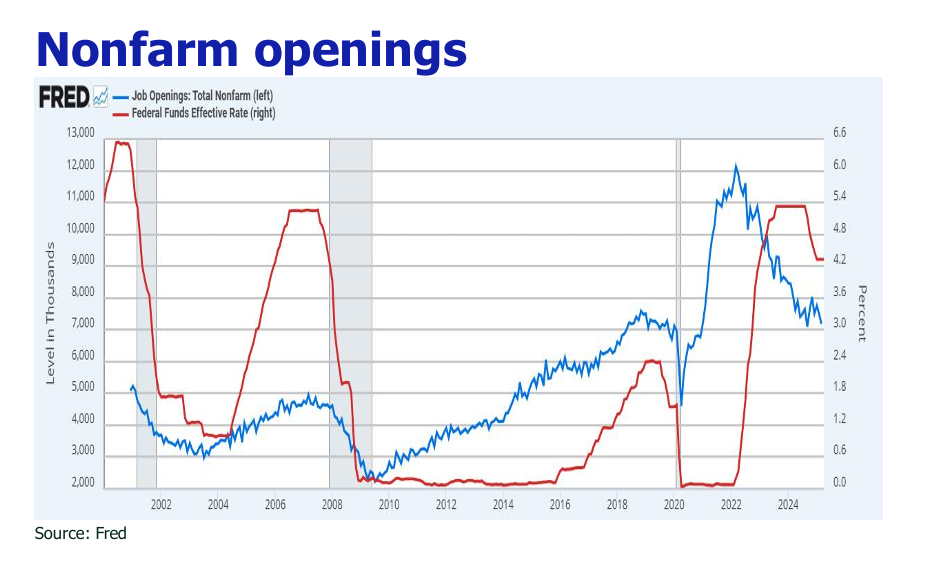

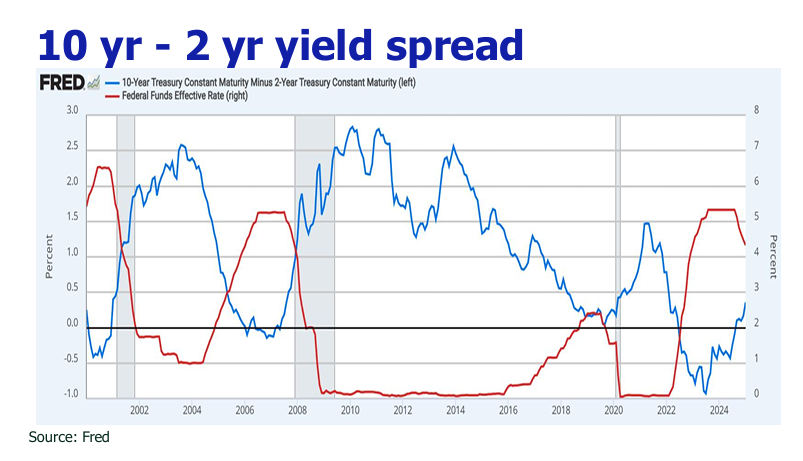

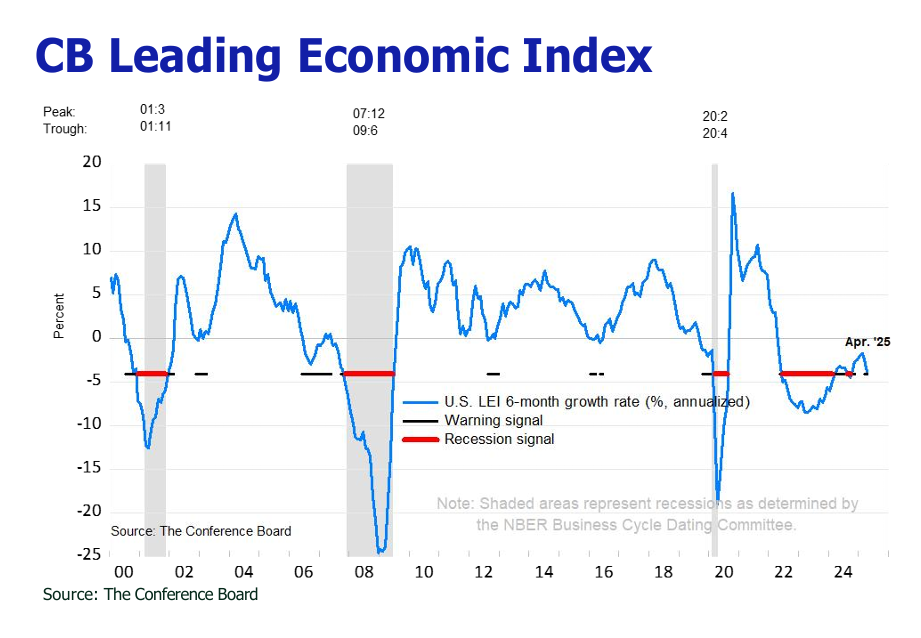

Despite a partial U.S.-China tariff reduction to 30% on Chinese imports and 10% on other nations (effective April 5, 2025), persistent tariffs continue to drive inflationary pressures. Economists estimate core PCE inflation could increase by 0.5–1 percentage point through 2026, exceeding the Federal Reserve’s 2% target. The temporary U.S.-China tariff truce (expiring August 2025) and trade tensions with the EU and Japan amplify policy uncertainty, discouraging business investment and complicating monetary policy. The Federal Reserve remains cautious, hesitant to cut rates amid potential tariff re-escalation.

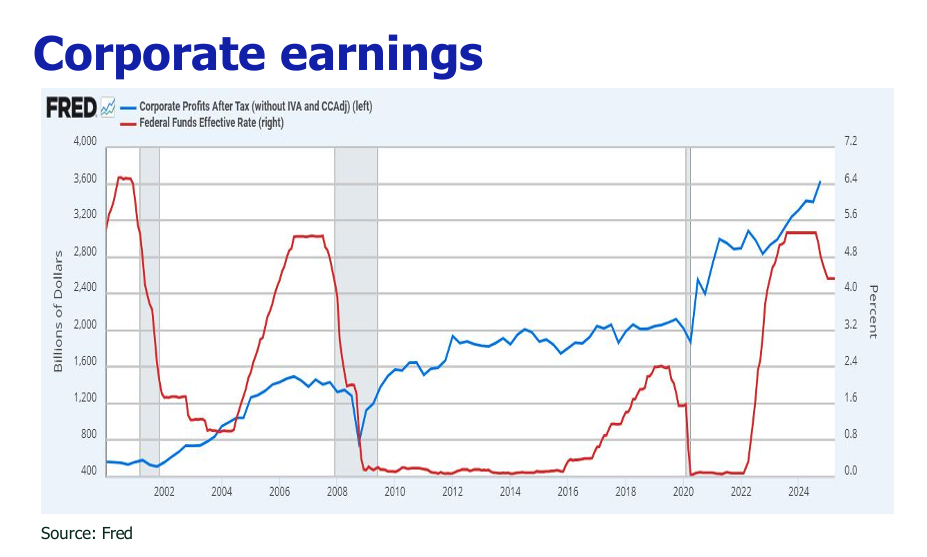

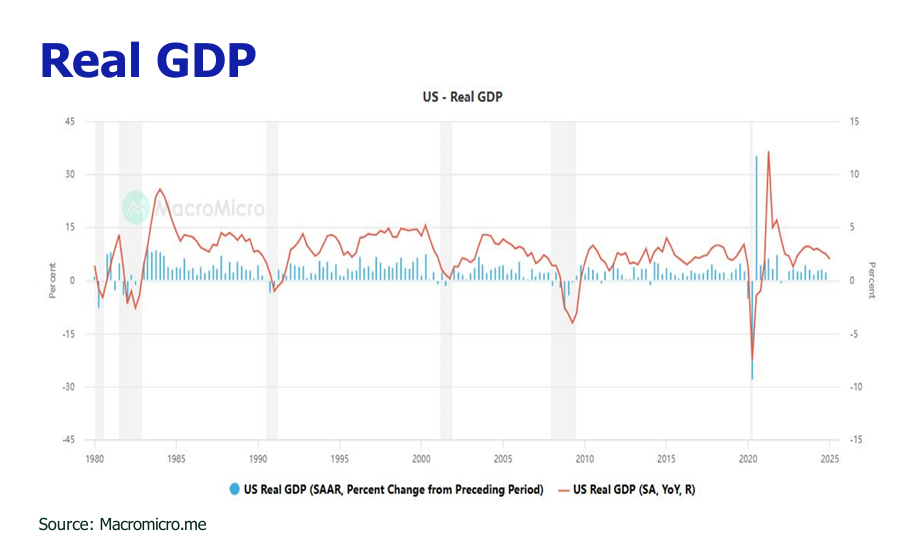

A resilient labor market, with a steady 4.2% unemployment rate and moderate growth (May PMI at 52.1, up 0.5 points), diminishes the need for immediate rate cuts, as tariff-induced recession risks have eased post-China de-escalation. However, sustained tariffs are projected to elevate inflation, suppress business investment and consumer spending, and reduce 2025 GDP growth to 1%–1.6%, down from ~2.75% (estimates range from 0.1–0.2 points by Goldman Sachs to 0.7–1.1 points by Yale). Consequently, we foresee no rate cuts within the next six months. However, intensifying tariff effects are likely to dampen consumption, elevate unemployment, and erode corporate profitability, potentially compelling the

Federal Reserve to contemplate rate reductions later in 2025 (Goldman Sachs predicts one cut in December).

2.U.S. dollar faces depreciation pressures amid tariff volatility and fiscal challenge.

The Trump administration’s erratic tariff policies have undermined investor confidence, spurring capital outflows from dollar-denominated assets and weakening the U.S. dollar’s safe-haven status. Escalating fiscal deficits, elevated debt levels, Moody’s downgrade to Aa1 (May 16, 2025), and rising Treasury yields exacerbate concerns about fiscal sustainability. Retaliatory tariffs from trade partners, including China, reduce global dollar demand. A potential Federal Reserve rate cut to spur growth could further depress yields, accelerating dollar depreciation. The U.S. dollar index has fallen ~6% from its 2025 peak to 99.53. Historical cycles (2009–2011, 2020) suggest a potential total decline of 12%–19%, driven by diminished safe-haven demand, lower rates, and shifts to non-dollar assets.

3. U.S. Treasuries grapple with prolonged downturn.

The U.S. Treasury faces a growing debt burden, driven by increased borrowing and deficits from the May 2025 tax cut bill. Public debt, at $36 trillion (123% 2024 GDP), has risen from $23 trillion in 2019. Over $8 trillion in Treasury securities will mature within 12 months, compared to $5 trillion in annual government revenue, requiring refinancing at higher rates (3.75%–5.25%), adding ~$300 billion yearly to servicing costs. The House-passed bill extending the 2017 TCJA is projected to increase deficits by $2.6–$5.7 trillion over 2025–2034. Elevated yields (4.4%–4.6% for 10-year, ~5% for 30-year) persist due to tariff-driven inflation, reduced foreign demand post-Moody’s Aa1 downgrade (May 2025), and fiscal concerns. A JP Morgan survey indicates client short positions, including central banks and speculative traders, have reached the highest level since mid-February 2025, signaling bearish sentiment on Treasuries.

Disclaimer

All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from current expectations.

We shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.